| I’m Randy Thanthong-Knight, a reporter on Canada’s economy and government in Ottawa. Today we’re looking at the economic-policy implications of the national election. Send us feedback and tips to ecodaily@bloomberg.net. And if you aren’t yet signed up to receive this newsletter, you can do so here. Mark Carney has made something of a career specialty out of dealing with crises. He was at the Bank of Canada’s helm during the financial meltdown of 2008, and later steered the Bank of England through Brexit. Canada’s Liberal party was perhaps in a popularity crisis when he replaced Prime Minister Justin Trudeau earlier this year, and Carney helped salvage its fortunes as the Liberals came behind to win on Monday. In a way, the former central banker pulled off what Kamala Harris and the Democrats wanted to achieve when they turned Joe Biden out ahead of the US presidential election last year. With most of Monday’s ballot results now in, the former Goldman Sachs banker has secured a fourth straight term for the Liberals. On to the next challenge: dealing with the dark economic clouds that are rolling in from the south. Under Trump, the US has already implemented a raft of tariff hikes on Canadian goods, with potentially more to come. That’s tough for a Canadian economy highly dependent on trading with its southern neighbor. Canada’s GDP is already expected to contract this quarter and remain flat in the next one as businesses and consumers cut spending. That’s essentially a half-year period of no economic growth right at the start of Carney’s term as prime minister. It’s rare for a new Canadian prime minister to come to power at the time of such a rapidly deteriorating economic outlook. And it means Carney’s government will likely need to spend even more than his team had projected, at least for a while. And that’s after the Liberals already expected to run deeper deficits than Trudeau’s administration. Even with all of the ambitious election promises — including income tax cuts, defense spending increases, housing investments and broader fiscal stimulus — some economists still expect a recession in Canada this year. For a prime minister whose campaign platform centered around assuring anxious voters the country could win the trade war, Carney risks looking like he has overpromised and underdelivered to some voters. His mettle as a crisis fighter is set to be tested once again. (Correction: The introduction section of yesterday’s Economics Daily incorrectly referred to Australia’s current ruling party as being center-right. It is center-left.) Executive orders. Trade wars. Elon Musk and DOGE. Trump’s second term has been nothing short of eventful. Bloomberg reporters recap his first 100 days in a Live Q&A on May 1 at 11 a.m. EDT. Tune in here. The Best of Bloomberg Economics | - The Bank of Thailand cut interest rates, Colombia may stay on hold today and Bank of Japan policy is likely to be unchanged on Thursday.

- Germany’s Social Democrats voted for a coalition deal that will make Friedrich Merz chancellor of Europe’s biggest economy.

- Chinese travelers may fork out a record $968 billion on mainland trips this year, making domestic tourism a bright spot.

- UK house prices saw the biggest drop in almost two years in April as a tax break expired and consumer confidence tumbled.

- Consumer goods companies are seeing early signs of demand pick up among the 400-million strong group of urban shoppers in India.

- South Africa’s finance minister will make a third attempt to pass a budget, while Mozambique will cut spending by 9%.

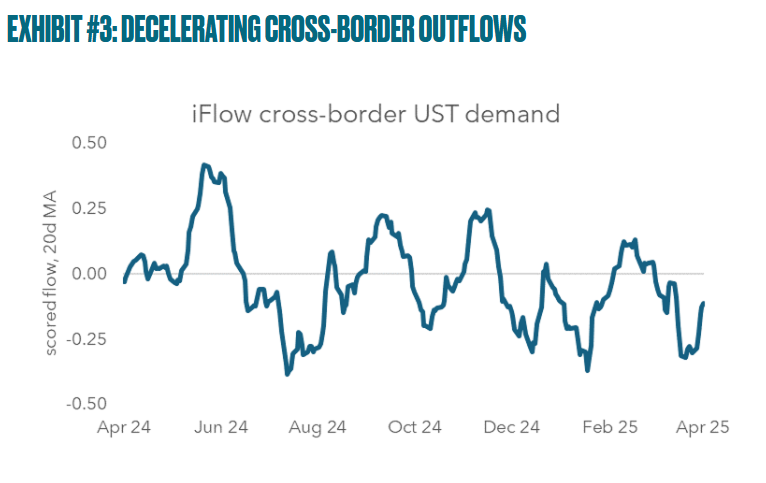

When US government debt tumbled in the aftermath of Trump’s “reciprocal” tariff announcement in early April, a key debate was the extent to which foreign investors were bailing out. Analysis from BNY, which oversees more than $50 trillion in custody assets, offers insight. BNY’s so-called iFlow reports track purchases of foreign exchange, equities and bonds on a daily basis. The figures did show the oversees asset management community was a “heavy seller” of Treasuries during the turmoil earlier this month. John Velis, a strategist at BNY, said more recent data show “cross-border investors have moderated their selling.”  Source: BNY Markets, iFlow “A slowdown in outflows is a positive development in a market context that is questioning US assets’ safe haven properties,” Velis wrote in a note. “However, until we see a sustained return of positive inflows, we remain wary that investor demand from abroad is slowly deteriorating.” |