|

Google and Meta's vast UK earnings revealed | Express editor interview

Press Gazette dares Google and Meta to be more transparent about UK earnings as we provide our own estimate based on the latest AA/WARC UK advertising spend figures

Good morning and welcome to your weekly Future of Media update from Press Gazette on Thursday 1 May, brought to you today in association with Sophi, Mather’s AI-powered revenue optimisation suite.

Dynamic paywalls remain a hot topic in publishing, and knowing how to use them strategically can be a powerful driver of revenue growth. In today’s feature, Mather explores how publishers are evolving their approach to find the right balance between user privacy, reader engagement, and subscription growth.

The latest official figures suggest the UK advertising market is booming - for some at least.

It grew to a record total size of £42.6bn last year with the vast majority spent online, according to AA/WARC.

If you count up everything spent with national and regional newsbrands plus the magazine industry (in print and online) you come up with a total publisher ad-spend of £1.6bn (or 3.8% of the market). That compares with a 39% market share for publishers in 2007.

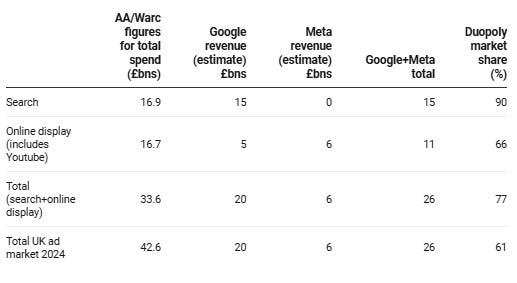

Most of the rest of the money is going to just two US companies: Alphabet (Google) and Meta.

The two tech giants make it intentionally difficult to deduce their revenue from particular territories (probably because legislators and other stakeholders would be appalled if they knew the truth).

But based on the available data, and deploying GCSE maths skills which have been newly sharpened through helping a teenager revise, I have come up with estimated UK ad revenue totals for both Meta and Google. The sums involved are stupendous.

Their total share of adspend in the UK is (I believe) likely to be around the 60% mark.

In cash terms I reckon around £26bn a year is spent on advertising with them in the UK every year (full story here).

This is based on what we know about their size in the market, deductions based on their published revenue figures and the AA/WARC numbers.

By publishing these figures I am daring Google and Meta to get back to me with more accurate numbers and given the huge power they wield in the UK they really should be more transparent. If these figures are in the right ballpark it is very hard to see how legislators can do anything else except tackle these vast monopolies.

UK car exports to the US have been much in the news in the wake of Trump’s tariffs and are worth about £6bn a year. This sum is peanuts compared to the US takeover of the UK advertising market (and so our media in general).

From our sponsor

Sophi, developed in the newsroom of The Globe and Mail and now trusted by 300+ news sites, is celebrating 10 years of helping publishers grow revenue with smarter, AI-powered decisions.

📈 Case Study: The Philadelphia Inquirer

When static rules and manual paywall tweaks began limiting subscription growth, The Inquirer turned to Sophi’s AI-powered Dynamic Paywall Engine to automate decisions and strike a better balance between engagement, ad revenue, and conversions.

The results?

✅ 35% increase in direct paywall subscriptions

✅ 13% lift in overall conversions

✅ Reader engagement maintained

With AI optimizing every decision, The Inquirer exceeded its 2024 subscriber goals, despite industry challenges.

On Press Gazette:

Google and Meta’s vast estimated UK earnings revealed

Google and Meta accounted for at least half the record £42.6bn spent on UK advertising last year, according to Press Gazette estimates.

How Express editor Tom Hunt plans to set title up for next 125 years

“If you’d have asked me three months ago about revenue, I would never have mentioned Facebook monetisation, and yet, we’re now getting paid by Facebook for engagement.”

Content licensing for publishers: Five key questions answered (promoted)

There are huge opportunities for publishers to make revenue from existing content and brands at no extra cost.