| | In today’s edition, a reality check for CEOs, and a real-time pulse check of the US economy. ͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Business |  |

| |

|

- America, banana republic?

- Unpacking a weird GDP

- Apple skewered on antitrust

- Big Oil’s big problem

- Musk’s DOGE days

- WeChat diplomacy

|

|

I wrote in annoyance on Tuesday about the doublespeak from many CEOs right now, who in private have sharp criticisms of the Trump administration’s policies and in public find their mouths suddenly full of meal. It’s not just that their ducking makes our jobs — explaining what’s happening right now — harder, but it risks a credibility gap that big business, already pretty low in public esteem, can’t afford. The kerfuffle this week around Amazon’s briefly entertained idea to explicitly call out the price increases attributable to tariffs (in a very small part of its business) is a case in point: Without a clear understanding, consumers may think companies are price-gouging. Jeff Bezos, who has steered The Washington Post rightward and donated $1 million to President Donald Trump, probably has the capital to resist the White House briefing room podium pressure. CEOs may have over-learned the lesson from the political reset of the past two years. Under conservative criticism and the threat of consumer boycotts, they retreated from politics. But acknowledging the trouble with Trump’s tariffs isn’t political. It’s squarely a business issue, and the gap between the economic reality and the sound bites we’re getting from executives is starting to make it look like they just haven’t noticed. Two-thirds of Americans surveyed in a new report from Morning Consult said CEOs should weigh in on the economy. And even among Democrats, there’s more support for executives to criticize Trump’s tariffs than his deportations. Also, I’ll be in Los Angeles next week at the annual Milken Institute conference — say hi if you’re there. And for the rest of you, we’ll have a gut check on the capital class. |

|

Is the US an emerging market? |

There was a striking juxtaposition in Washington last week, Matt Klein writes in a column for Semafor today. Finance ministers and central bankers from the world’s “emerging markets” — countries like Brazil, Argentina, and Vietnam, that are in the process of building modern, industrial economies — were in DC for the spring meetings of the IMF and World Bank. These are people who know that their countries depend, at least to a degree, on the financial trust and goodwill of others, and they came bearing a message of humility and competence.  Elizabeth Frantz/Reuters Elizabeth Frantz/ReutersThen there were the Trump officials. The US is not an emerging market, yet, but its prosperity still depends on being an attractive place to invest and build businesses — and its huge budget deficits depend on investors being willing to buy its debt. That is now under threat. As Citadel’s Ken Griffin said at Semafor’s World Economic Summit, the Trump administration has put America’s “brand at risk” andit could take “a lifetime to repair the damage that has been done.” The US risks becoming a place where “investors are less confident that their assets are safe, quicker to run for the exits at the first sign of trouble, and more willing to hedge by holding a bit more of their wealth outside the country,” Klein writes. (You can catch more of his writing about trade at The Overshoot.) |

|

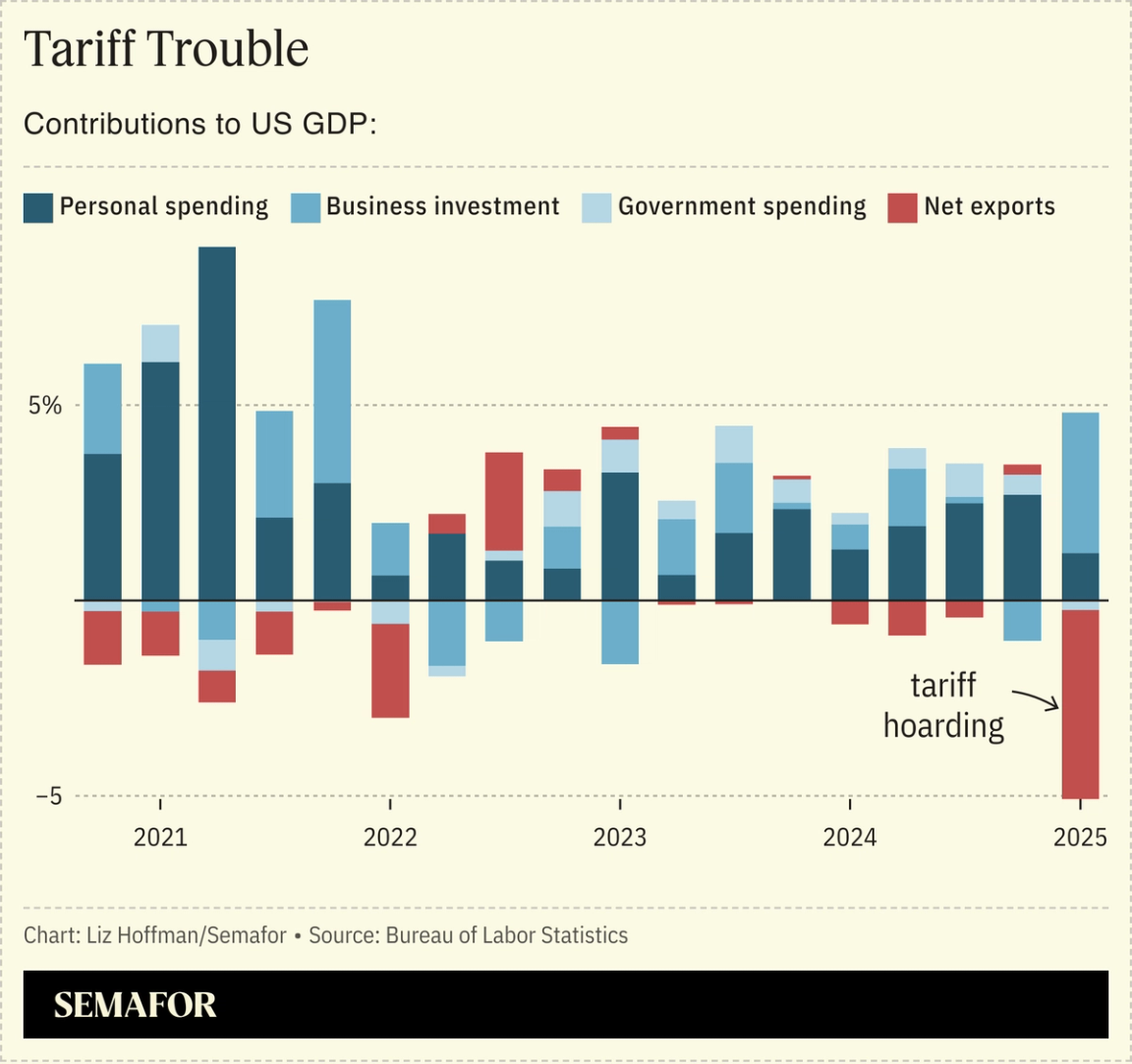

Are we in a recession? That will be a matter for the National Bureau of Economic Research, the country’s recession-callers, and a hazy one at that. NBER considers what economists call the three Ds — the depth of a downturn, its diffusion across different industries and regions, and its duration. They are diagnosed in retrospect, and most are already over by the time they are officially declared.  Tuesday’s GDP data, which showed the US economy shrank 0.3% between Jan. 1 and March 31, was “better than it looked at first glance,” Jed Kolko, an economist who worked in Biden’s Commerce Department, told Semafor. The decline was largely down to a surge in imports as consumers and businesses rushed to buy things before tariffs make them more expensive. (Kolko loaded up on rice — it “never goes bad” and the US imports most of it from Asia.) That surge is likely to disappear, and other measures of economic health that NBER will be watching, like consumer wages and industrial production, held up in March and even into April, said Kolko, who is now a senior adviser to the JPMorganChase Institute. The group tracks credit-card spending by Chase customers, which Kolko said is still strong, a message echoed this morning by Visa’s CEO and last week by Mastercard’s. Query where they’re spending: McDonald’s was the latest consumer canary to report a sharp drop in sales. But Kolko says the consumer is “entering whatever the next phase of the economy is from a position of strength.” |

|

Apple’s App Store may face criminal probe |

Tingshu Wang/File Photo/Reuters Tingshu Wang/File Photo/ReutersA federal judge banned Apple from charging US customers fees on purchases via third-party apps and took the extraordinary step of referring the company’s conduct to federal criminal prosecutors. CEO Tim Cook and a deputy, Phil Schiller, came under sharp criticism by the judge, who found that they had “willfully” disobeyed a previous court order to allow app developers to send customers to their own websites, avoiding Apple’s App Store fees, which can be up to 30%. The ruling will tee up a juicy target for Gail Slater, Trump’s top Justice Department official in charge of antitrust. In an expansive speech on Monday, Slater said that “antitrust in the United States is law enforcement. It is not regulation.” If DOJ is serious about “a preference for litigation over regulation,” as Slater said, bringing charges against Apple would be a high-profile way to show it. |

|

Trump’s trade war threatens Big Oil |

Nick Oxford/Reuters Nick Oxford/ReutersTrump was supposed to usher in a golden era for American energy: “If I’m not president, you’re f*cked,” he told execs at Mar-a-Lago after the election. But slumping oil prices have put the industry’s dividends and buybacks — a key reason investors buy their stock — at risk, forcing companies to choose between appeasing Wall Street and adopting Trump’s “drill, baby, drill” approach. Shareholders with long memories of the 2010s shale boom, when drillers spent themselves into bankruptcy, are nervous, and with good reason. Crude slid below $60 per barrel in the US this week, its lowest point since the pandemic, pushing the boundary of where many oil companies can turn a profit. RBC estimates that Exxon needs oil at $88 a barrel, and Chevron needs $95, to cover their buybacks and dividends. Last week, US independent shale driller Matador became the first to admit it would need to shut down a rig because of dipping prices. Widespread cutbacks in capital expenditure means a longer period of playing catch-up on production once oil prices start to rise again, Semafor’s Tim McDonnell writes. Chevron, ExxonMobil, and Shell all report quarterly earnings tomorrow. |

|

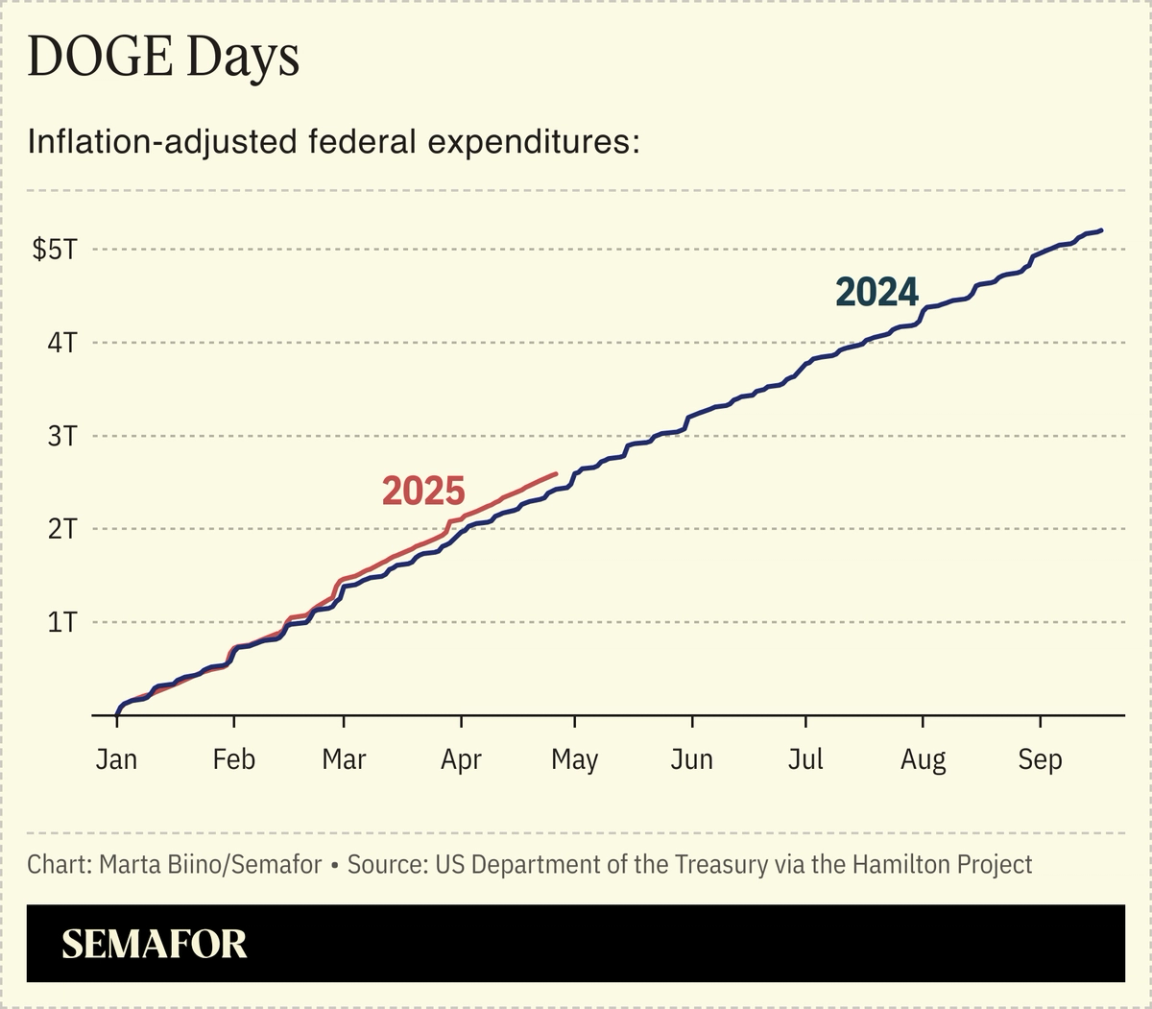

Elon Musk became a fixture of Trump’s White House during its first 100 days, presiding over broad federal cuts and firings that thrilled Republicans while sparking public protests and sporadic acts of Tesla vandalism. Now, Semafor’s Shelby Talcott writes, he’s planning to focus more on his companies and directly manage DOGE less, even if he’ll still be present in DC (The Wall Street Journal reported Wednesday that Tesla’s board opened a search for a CEO to succeed Musk as profits tanked, which the company later denied.) “DOGE is a way of life, like Buddhism,” Musk said Wednesday night, adding that the cost-cutting entity will keep going for “as long as the president wants.”  Musk insists that DOGE can meet its diminished spending-cut target of $1 trillion. The group claims it has so far found $160 billion in savings, though its accounting has been criticized by, among others, Steve Bannon, who told Semafor last week that “we need to have a very specific accounting of what he found, as far as fraud goes and waste, and I mean details… None of this makes sense.” |

|

Beijing’s sock puppets sound ready to deal |

Trump and Xi Jinping in 2019. Kevin Lamarque/File Photo/Reuters. Trump and Xi Jinping in 2019. Kevin Lamarque/File Photo/Reuters.Posts from two widely followed social-media accounts with established ties to the Chinese government appear to show that Beijing is ready to make a deal with Trump — though won’t be seen asking for the meeting, notes Substacker Zichen Wang, a China analyst on leave from a state-linked think tank. “China will always maintain an open attitude toward the ‘olive branches’ extended by the United States and welcomes the resolution of differences through dialogue and negotiation,” goes a WeChat post by Chairman Rabbit, a well-connected blogger. “We are open and confident,” wrote another. China’s commerce ministry has taken a tough stand in public statements, essentially demanding that Trump withdraw the reciprocal tariffs as a starting point for negotiation, so any change in tone is being carefully watched. Elsewhere in China: Shein is scrambling to divert clothes bound for the US to other markets, and ramp up manufacturing in Brazil and other countries that face smaller tariffs. And: “We don’t care about sales to the United States,” one toy wholesaler told the BBC. “Other countries have money, too!” |

|

➚ BUY: Conflicts of interest. Kohl’s fired its CEO just six months into his tenure for awarding favorable contracts and a consulting gig to a company founded by a romantic partner of his. Ashley Buchanan will have to repay his $2.5 million signing bonus. ➘ SELL: Interests of conflict. US defense stocks have been surprise losers lately, despite growing geopolitical tensions and governments rearming in Europe. Northrup Grumman and RTX are down sharply since reporting weak earnings last month. |

|

What do all budding billionaires have in common? They spend five minutes every morning reading The Hustle. The Hustle’s daily newsletter is a breezy, five-minute morning read that keeps you sharp on e |

|

|