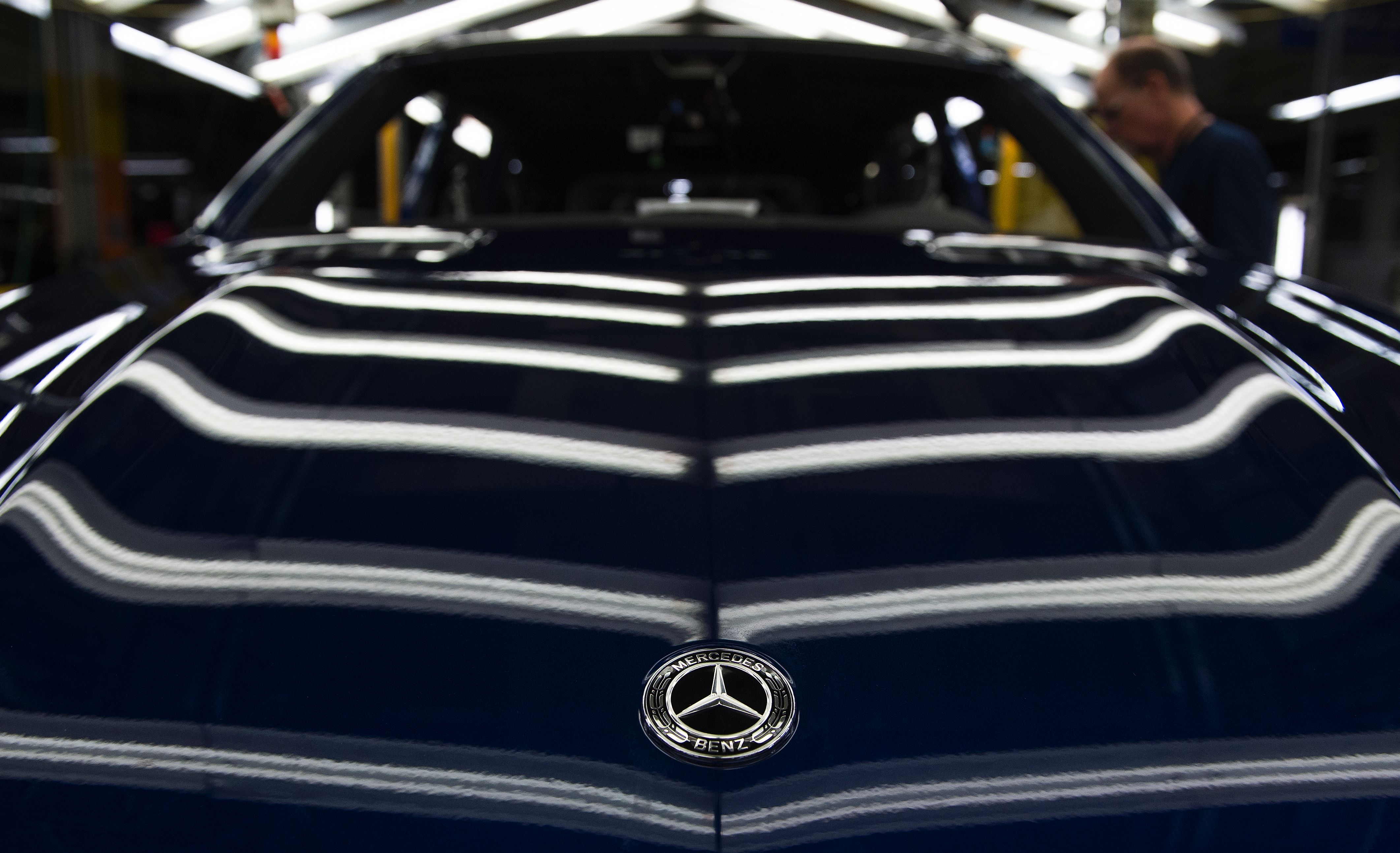

| Thanks for reading Hyperdrive, Bloomberg’s newsletter on the future of the auto world. Read today’s featured story in full online here. General Motors cut its full-year profit outlook due to as much as $5 billion of exposure to auto tariffs, among the biggest financial tolls a company has projected so far from President Donald Trump’s trade war. The automaker now expects earnings before interest and taxes to fall into a range of $10 billion to $12.5 billion, down from its initial guidance in January of as much as $15.7 billion. Trump earlier this week issued what he’s characterized as relief for automakers by lowering some levies on imported vehicles and parts. Even so, GM expects a hit to profit this year unless trade deals are cut that would reduce the automaker’s exposure. “We look forward to maintaining our strong dialogue with the administration on trade and other policies as they continue to evolve,” CEO Mary Barra said Thursday in a letter to shareholders. “As you know, there are ongoing discussions with key trade partners that may also have an impact. We will continue to be nimble and disciplined and keep you updated as we know more.”  The view of GM’s Renaissance Center building from across the Detroit River in Windsor, Ontario. Photographer: Cole Burston/Bloomberg Only two days ago, GM suspended guidance and postponed an earnings call with analysts, saying it wanted to wait for the Trump administration to announce more tariff details. The company said it expects to defray at least 30% of its tariff exposure through US production offsets. Its guidance assumes current car pricing remains relatively consistent for the remainder of the year. GM has been working to reduce its exposure to tariffs and lower the impact on profit. One lever it’s pulling: increasing truck production at a plant in Indiana to meet demand for un-tariffed pickups. But the company also has moved to preserve cash. GM cut capital spending in the first quarter by $900 million to $1.8 billion. GM beat Wall Street estimates with a profit of $2.78 a share reported earlier this week, but earnings fell due to lower truck production and foreign exchange costs. Barra told analysts on the rescheduled earnings call Thursday that tariffs had a “small impact” on first-quarter results.  Chevrolet Trax SUVs lined up at a dealership in Colma, California, in March. Photographer: David Paul Morris/Bloomberg Trump signed two executive orders Tuesday that reduced his initial tariffs on vehicles and parts. The first executive order gave vehicles a reprieve from separate tariffs on aluminum and steel, so levies and parts and metals wouldn’t be compounded. He also changed the 25% tariff on imported auto parts that takes effect on May 3. Carmakers that produce and sell completed automobiles in the US can claim an offset worth up to 3.75% of the value of American-made vehicles. That offset will reduce in one year to as much as 2.5% of the value of those cars, and then be eliminated the following year. The offset will be available for cars that were produced after April 3. Automakers still face a 25% duty on imported vehicles, which hurts GM because it makes several popular models in Canada, Mexico and South Korea. The company has one plant each in Canada and Mexico making its profitable and top-selling pickup trucks. Its most affordable models, the Chevrolet Equinox and Trax SUVs, also are made outside the US.  Tesla CEO Elon Musk wearing multiple hats during a cabinet meeting Wednesday at the White House. Photographer: Ken Cedeno/UPI Tesla’s chair denied that board members started a search for a CEO to succeed Elon Musk, calling a Wall Street Journal story “absolutely false.” The Journal reported late Wednesday that unidentified Tesla board members had reached out to executive-search firms about a month ago, citing people familiar with the discussions. “The CEO of Tesla is Elon Musk and the board is highly confident in his ability to continue executing on the exciting growth plan ahead,” Tesla Chair Robyn Denholm said on X.  A Mercedes-Benz under inspection lights at the carmaker’s Alabama factory. Photographer: Andrew Caballero/Getty Images Mercedes-Benz plans to move production of another vehicle to the US as President Donald Trump’s tariffs raise costs and threaten to make imported cars uncompetitive. The German automaker said it will shift assembly of a “core segment vehicle” to its factory in Tuscaloosa, Alabama, by 2027. Though Mercedes didn’t specify which model, its most popular import in that category is the GLC sport utility vehicle — the company sold 64,163 units in the US last year. |