| | Donald Trump is undecided on whether to strike Iran, India and Canada reset ties, and pop music char͏ ͏ ͏ ͏ ͏ ͏ |

| |   ALEXANDRIA ALEXANDRIA |   JAKARTA JAKARTA |   CHIYODA CITY CHIYODA CITY |

| Flagship |  |

| |

|

The World Today |  - Trump undecided on Iran

- Iran won’t give up on nuclear

- Markets resilient amid war

- US Fed holds rates steady

- Changing trade corridors

- India’s diplomatic win, loss

- Nippon-US Steel deal closes

- Companies recast DEI

- Pop music’s vibe shift

- “Human Written” book

A new exhibition reveals that we might not know Cleopatra as well as we think we do. |

|

Trump undecided on Iran strike |

Nathan Howard/Reuters Nathan Howard/ReutersUS President Donald Trump said Wednesday he hasn’t decided whether to join Israel in striking Iran, after Tehran’s leader declared he would “never surrender” following nearly a week of conflict. “I may do it. I may not do it,” Trump said, one of several cryptic remarks he has given about potentially getting involved. While forecasting Trump’s decisions is always a fool’s errand, that he is even considering stepping in “shows how far his version of ‘America First’ has come from its non-interventionist origins,” Semafor’s Burgess Everett and Shelby Talcott wrote, reflecting a fractured Republican Party that is giving Trump wildly divergent guidance on the conflict. One Democratic senator called Trump’s position “unstrategic ambiguity.” |

|

Iran unlikely to give up nuclear dream |

Majid Asgaripour/WANA via Reuters Majid Asgaripour/WANA via ReutersIran is unlikely to give up its nuclear ambitions despite Israel’s assault and US pressure, two experts argued. No past, present, or future Iranian regime would abandon its nuclear aspirations, because doing so would severely diminish its regional status, an Iranian history scholar wrote in the Financial Times. Israel’s attacks may have even “reinforced the incentive for the Islamic republic to rush to acquire a nuclear deterrent.” But doubling down is a “very dicey bet and could leave the regime isolated and broke,” akin to North Korea, an analyst wrote in Foreign Affairs: In that sense, Iran’s leaders have already lost their country’s long-term struggle with Israel, as “the regional status quo they established is finished.” |

|

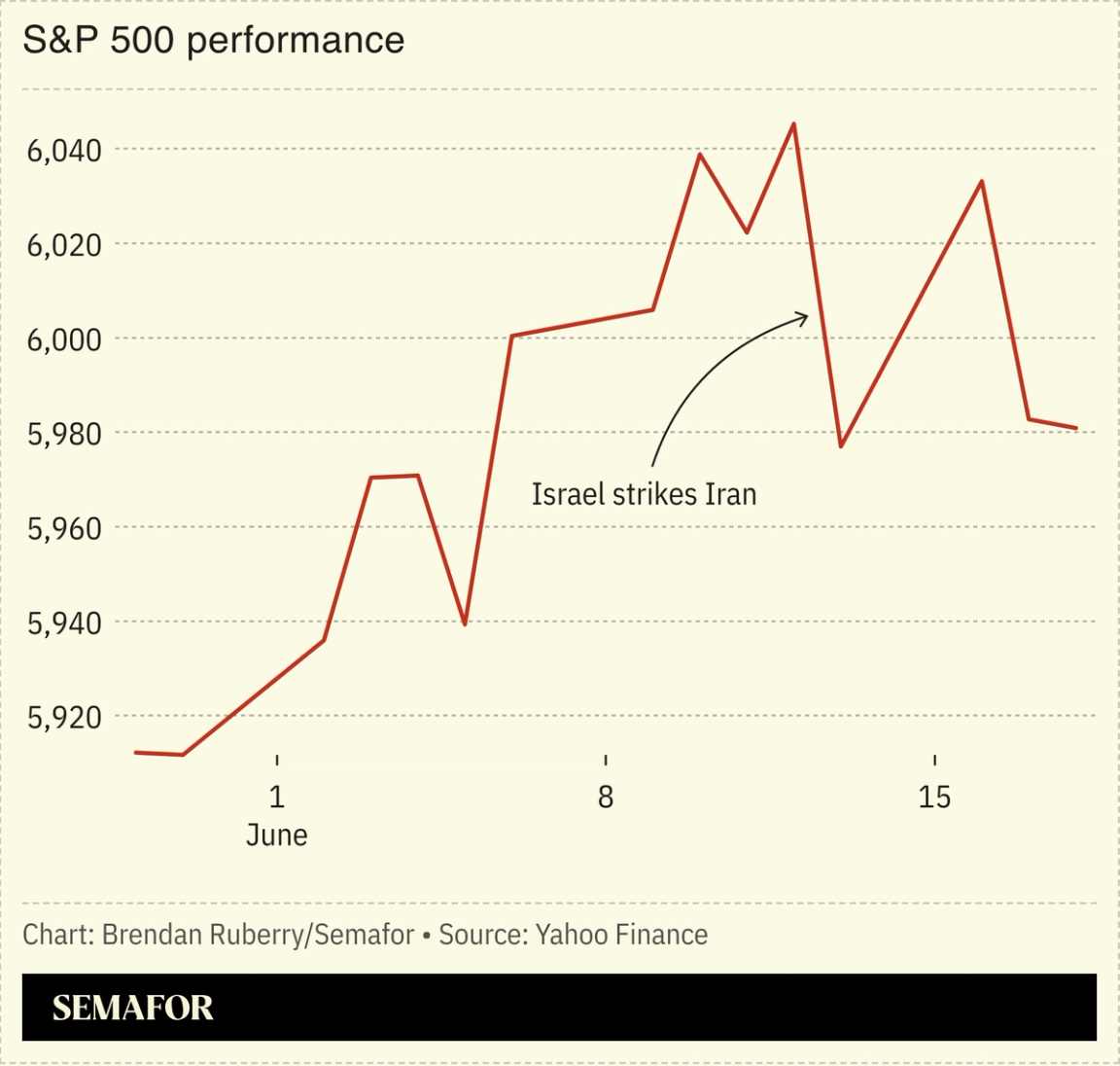

Markets rebound amid wars |

Global markets’ quick rebound after Israel attacked Iran reflects a decadeslong pattern of stocks reacting to geopolitical crises, analysts noted. Analysis of 25 major geopolitical incidents going back to the 1941 Japanese attack on Pearl Harbor found that the impact on the markets was limited and that full recoveries can take just a couple of months, The New York Times wrote. Deutsche Bank analysts concluded that geopolitics “doesn’t… matter much for long-run market performance.” Investors are using the viral catchphrase “nothing ever happens” to capture that sentiment: A Baird strategist told MarketWatch that people tend to forget “that [the event] truly needs to be a surprise for it to really move the needle.” |

|

Fed keeps rates steady, cuts outlook |

Kevin Mohatt/Reuters Kevin Mohatt/ReutersThe US Federal Reserve held interest rates steady for the fourth straight meeting Wednesday, while cutting the outlook for the country’s economy. The Fed forecast 1.4% annual GDP growth, down from its earlier estimate of 1.7%, and raised its inflation prediction. The decision underscored the central bank’s wait-and-see posture; Fed Chair Jerome Powell said “uncertain” or “uncertainty” more than 15 times in his press conference. While recent inflation readings have been muted, Powell noted that more price increases are expected as a result of President Donald Trump’s tariffs, and the summer will be critical to determine the path forward. Trump renewed his criticism of Powell, calling him “stupid” for not cutting rates. |

|

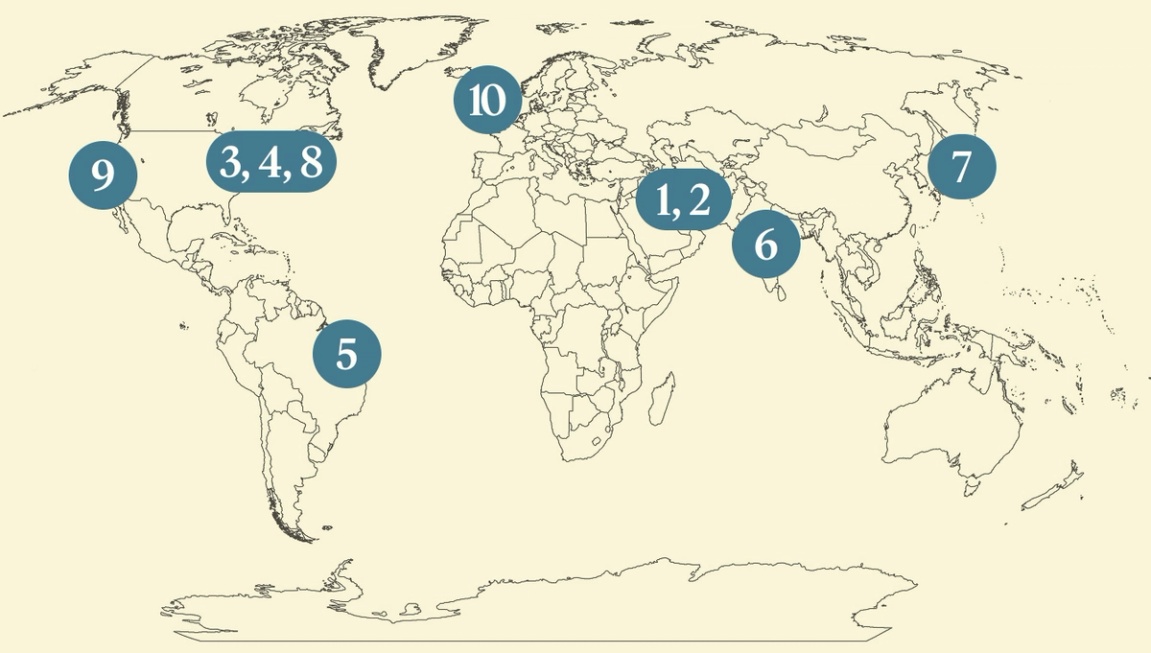

Global trade corridors fluctuate |

Go Nakamura/Reuters Go Nakamura/ReutersTrade routes and relations are mutating as US tariffs unleash uncertainty and countries make little progress on deals. Global trade is set to grow in the next 10 years, but more than 30% of that volume could move from one corridor to another, according to a new McKinsey report. Some of those shifts are already playing out: With Beijing facing higher US tariffs, more Chinese exports are being diverted to Southeast Asia, Latin America, and Europe, “reshaping economies and geopolitics” in the process, The New York Times reported. The changes are exacerbated by a lack of agreements to ease trade tensions. The G7 summit this week failed to yield new trade pacts between the US and other large economies. |

|

Amber Bracken/Reuters Amber Bracken/ReutersIndia reset ties with Canada as fresh strains emerged with the US. New Delhi and Ottawa agreed to reinstate their top envoys and renew visa services after their leaders met during the G7 summit, a major diplomatic breakthrough following a two-year rift over former Canadian premier Justin Trudeau’s accusations linking the Indian government to the killing of a Sikh separatist. But India’s North American diplomatic success didn’t extend to Washington: In a phone call with President Donald Trump on Tuesday, Prime Minister Narendra Modi disputed Trump’s insistence that he used trade deals to broker an India-Pakistan ceasefire — a claim the US president repeated just hours later. And Trump’s rare meeting with Pakistan’s army chief Wednesday could further rankle New Delhi. |

|

Nippon closes US Steel deal |

Issei Kato/Reuters Issei Kato/ReutersNippon Steel closed a $14.1 billion takeover of US Steel on Wednesday, in a deal that grants the Donald Trump administration an unusual degree of power over the corporation. The agreement, which follows an 18-month push to finalize the purchase, will transform Japan’s Nippon into the world’s second largest steelmaker, and give the company production facilities in the US that will help it avoid high steel tariffs. As part of the deal, the US government was given a “golden share,” allowing it to veto decisions to reduce production or staffing levels. Although Washington had traditionally criticized golden share agreements, the Trump administration may embrace the tool “to drive outcomes consistent with its ‘America First’ investment policy,” one analyst said. |

|

With so many financial newsletters competing for attention, it’s hard to find one that makes sense of the market. That’s why over 1 million savvy readers trust The Daily Upside for their daily dose of finance, economics, and investing insights. Created by Wall Street insiders, each issue delivers clear, actionable analysis — straight to your inbox. Subscribe for free today. |

|

Companies rebrand DEI programs |

Michael Brochstein/Sipa USA via Reuters Michael Brochstein/Sipa USA via ReutersUS companies are no longer flaunting diversity, equity, and inclusion statements and campaigns, but in many cases are offering the programs under new names. Overt DEI initiatives nowadays are “liable to attract unwanted scrutiny from the Trump administration,” a Wall Street Journal business columnist noted. So companies that still view those goals as important are using strategies to fly under the radar, such as using blander labels like “employee engagement,” or preserving benefits without explicitly promoting them. “Businesses approach DEI in whatever fashion they think is best for the bottom line,” Callum Borchers argued, and some clearly feel that certain elements of DEI are still valuable — but that advertising them is not. |

|

US political shift hits pop music |

|

|