| | While EV sales and battery manufacturing soar in China, they’re tumbling in the US.͏ ͏ ͏ ͏ ͏ ͏ |

| |   Memphis Memphis |   New Orleans New Orleans |   London London |

| Net Zero |  |

| |

|

- Oil and gas calm under fire

- China extends EV lead

- NAACP’s gas gripe

- Solar shares dim

- Hydrogen investors spooked

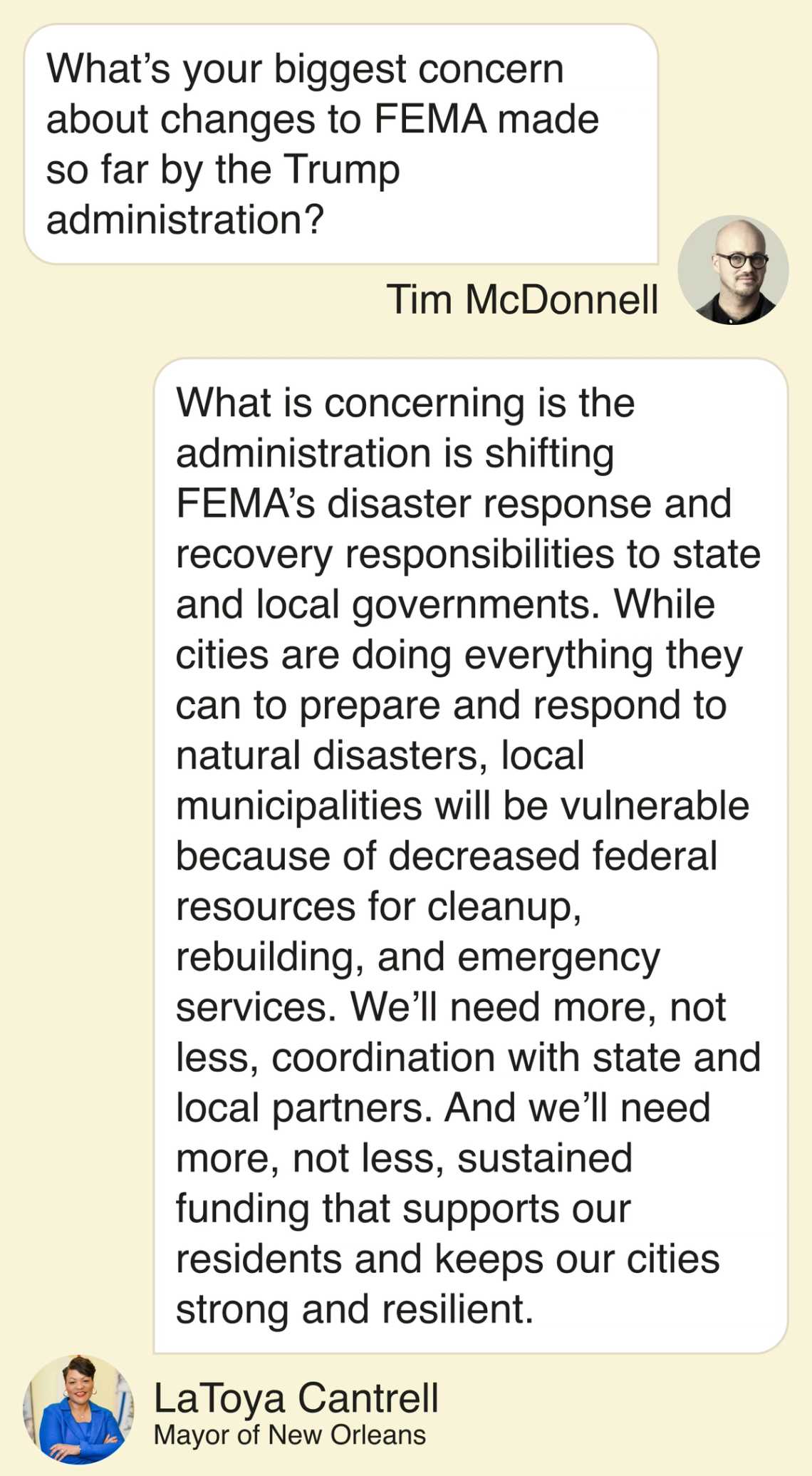

The mayor of New Orleans is worried about the Trump administration’s plans for FEMA. |

|

The British government this month published a major report that was as notable for what it didn’t say as for what it did. The Strategic Defense Review sought to lay out the country’s military outlook for the coming years: Co-written by a former NATO secretary general, a top British military commander, and an ex-Trump administration security staffer, the document is not typically one that is circulated in the climate community. Yet it has major implications for the sector, underlining the importance of the military in protecting Britain’s access to energy, stressing the urgency of decarbonization on domestic defense installations — including through the use of carbon capture and sequestration — and encouraging ramping up the use of renewables on overseas bases. And… that’s about it, which has analysts whom I spoke to worried: “There’s no sense that” Britain’s decarbonization efforts “are part of the same grand national plan” as the SDR, Adam Bell, director of policy at the policy consultancy Stonehaven and a former senior civil servant, told me. “At a fundamental level, it’s not calling out the issues on the environment,” added Hetti Barkworth-Nanton, the head of Ploughshare Innovations, which spins out and licenses UK defense ministry technology for the private sector. The UK is not unique in this respect: Few countries have truly tackled the energy transition’s implications for national security. How does a distributed, digitized grid in an electrified economy change a country’s risk profile and attack threats compared with fossil fuel-based power plants? What do officials need to prioritize in order to ensure their critical infrastructure is safe from foreign adversaries? And how might a country’s military help define and drive this effort? That is one of a number of issues I’m hoping to discuss with government officials, business executives, and NGO leaders during London Climate Action Week, starting on Monday. The pivot to clean power may be slowing — in part because a growing prioritization of defense spending in the West is putting pressure on government budgets — but it is advancing, and that has implications for businesses and governments in ways they have not fully grappled with. Defense is but one example. Will you be at London Climate Action Week? Drop me a line if so by replying to this briefing, or send me an email. |

|

Oil and gas calm under fire |

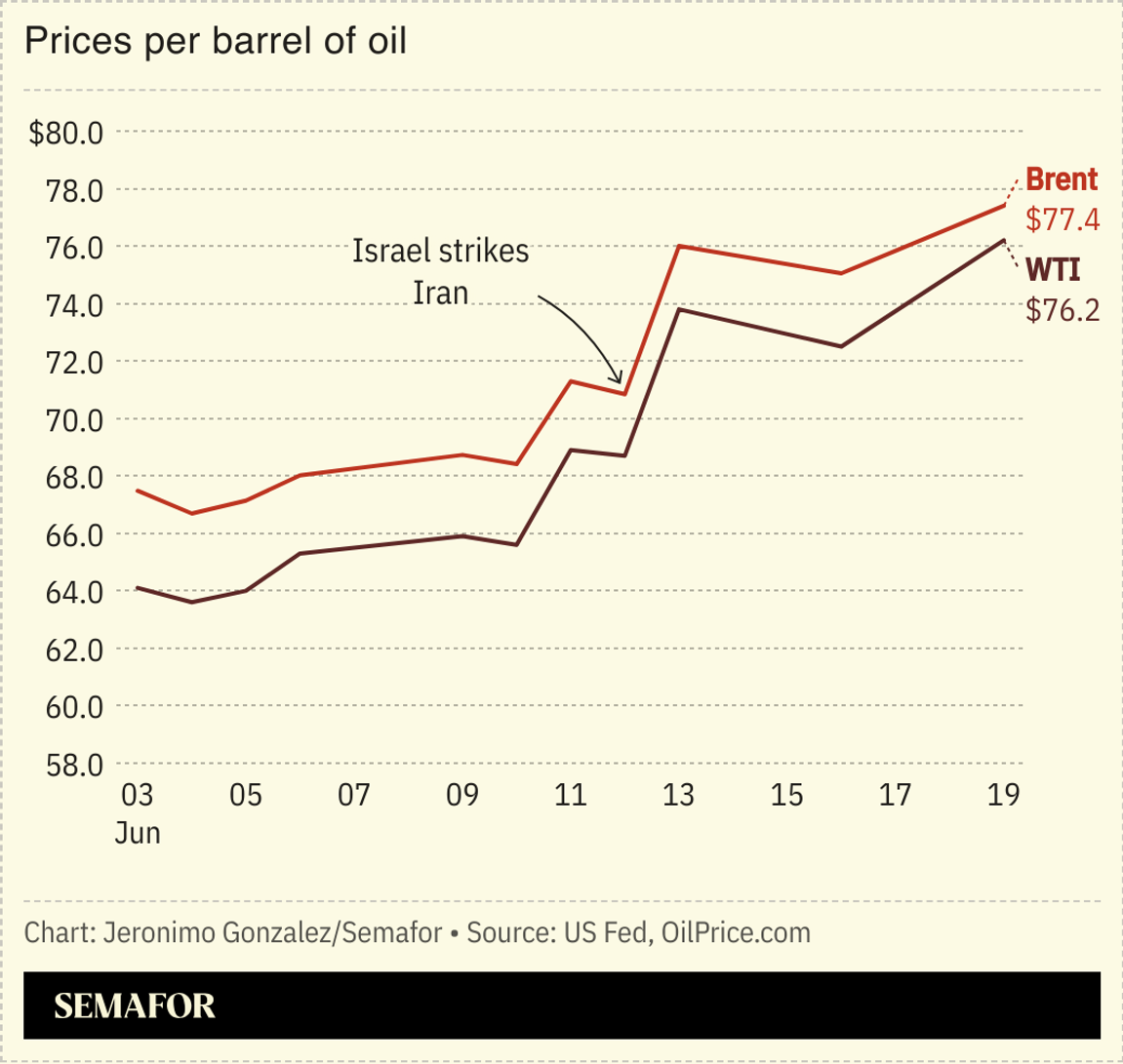

Global energy markets are stabilizing even as Israel and Iran continue to trade attacks. The price of Brent crude, the global benchmark, is hovering at around $76 per barrel, and analysts believe that unless Iran takes the extreme — and highly unlikely — step of closing the Strait of Hormuz, a significant further increase is unlikely. Natural gas prices are also stable, even though Iran is the world’s number-three supplier. If any Iranian gas production sites are taken offline by attacks, JPMorgan analysts wrote, key importers like Turkey will likely find sufficient replacements from Russian pipelines and the global LNG trade. But with US intervention in the conflict still highly uncertain, there are plenty of chances for gas and oil prices to swing either way. In the meantime, biofuels are trading at their highest levels in years, driven in part by hedging around the Iran conflict and by a Trump administration plan to increase biofuel blending requirements in the US gasoline supply. |

|

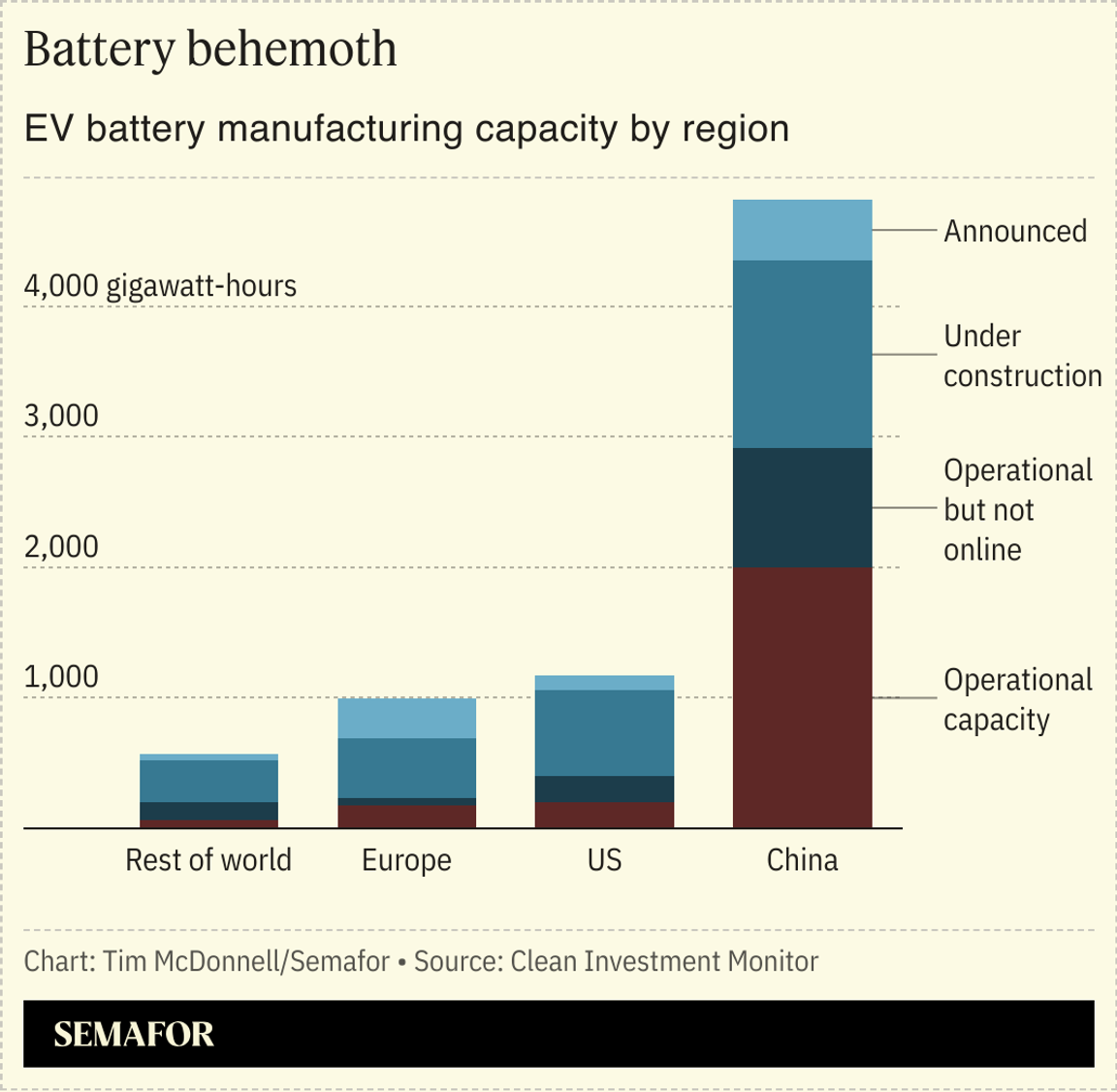

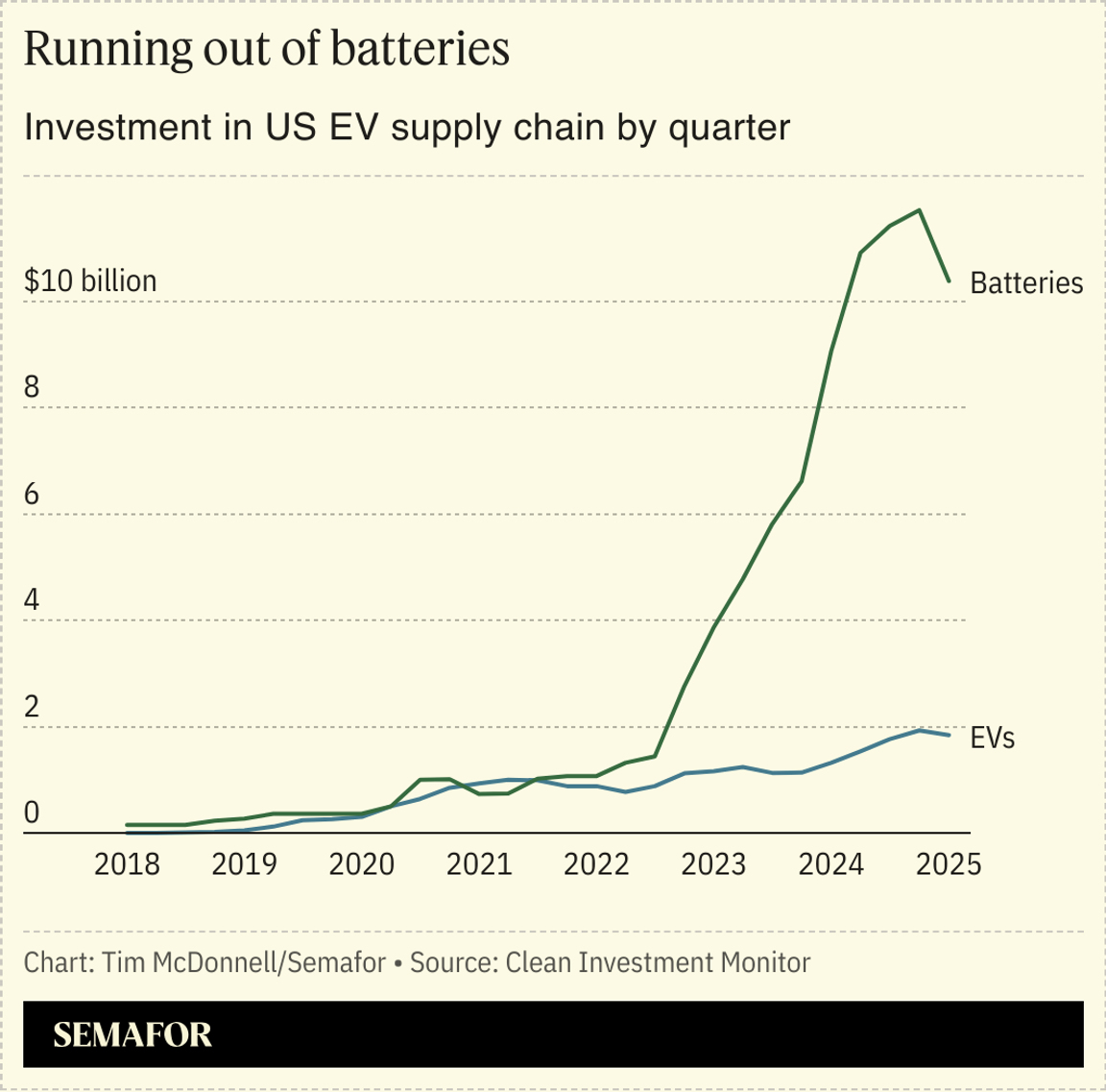

China’s booming EV market is leaving the US further in the dust. Global EV sales will reach a record of 22 million this year, up 25% from 2024, according to a new outlook from BloombergNEF. Two-thirds of those sales will be in China; just 7% will be in the US.  It’s not just sales: China also has a massive lead in EV battery manufacturing, capable of producing twice its own needs and 20% more than global demand. In the US, meanwhile, the Trump administration’s proposed cuts to EV tax credits will likely lead to a steep drop-off in sales of the vehicles. BloombergNEF now projects that EVs will account for 27% of total US car sales by 2030, compared with 48% in its outlook report last year. Thailand already has a higher rate of EV sales than the US. And while investment in American domestic battery manufacturing surged over the last few years, trade policy and tax credit uncertainty led inflows to fall off a cliff in the first half of this year, according to new data from the research consortium Clean Investment Monitor.  |

|

Nathan Howard/File Photo/Reuters Nathan Howard/File Photo/ReutersElon Musk’s AI firm is facing a legal challenge to its use of natural gas turbines to power a massive new data center. The NAACP said this week it intends to sue xAI, over what the civil rights group calls the illegal operation of gas generators at the site in Memphis, which it says are contributing to air pollution in the predominantly Black neighborhoods near the site. xAI says it has all the necessary permits. But the suit will likely become an important test of the restrictions data center companies could face in trying to supply their own power for new projects, and pits the power of local zoning laws against the Trump administration’s push for both AI supremacy and a resurgence of gas-fired power generation. |

|

From the Risky Business podcast: Journalist-poker pros Maria Konnikova and Nate Silver break down the odds, incentives, and risks behind the headlines, understanding who’s making moves and why. From unpacking AI hype to election forecasting, they analyze the choices shaping our democracy — because every move in politics is a calculation. Listen now. |

|

The drop in Sunrun’s share price this week following the US Senate’s budget proposal. Senate Republicans were more hawkish on cutting clean energy tax credits than most industry supporters had hoped, and solar company investors were among those who paid the price. Solar equipment manufacturers SolarEdge and Enphase also took a share price beating. |

|

Hydrogen investors spooked |

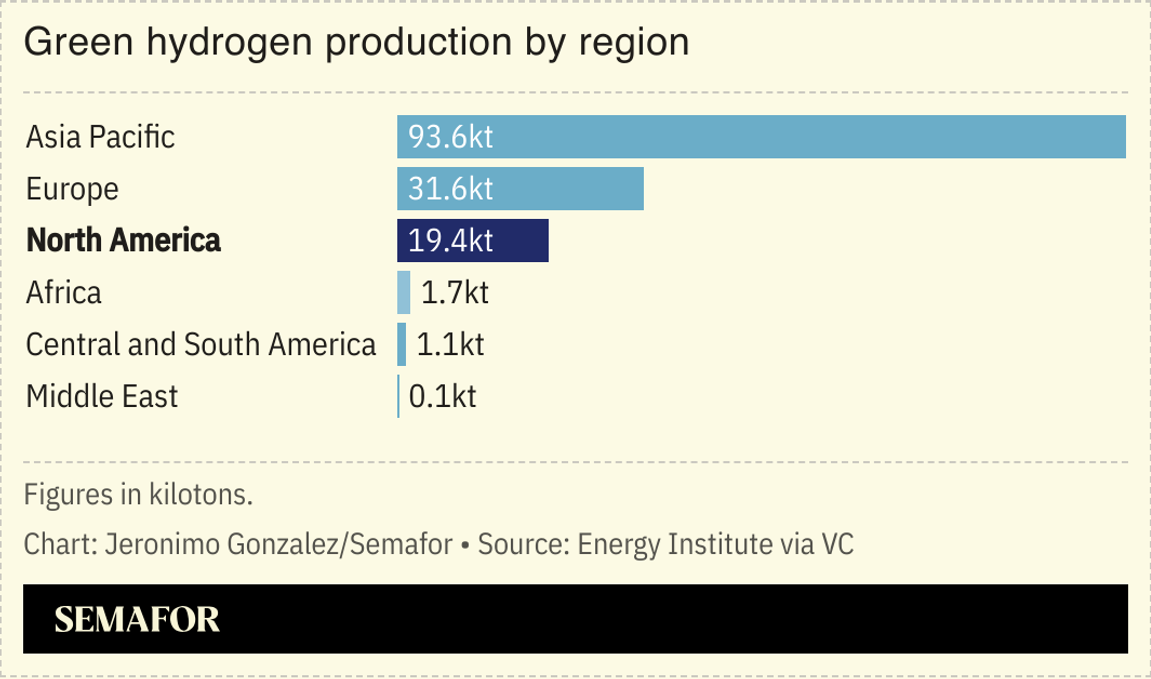

Hydrogen investors are worried that the once-promising US market looks increasingly dim. Tax credits for hydrogen production weren’t protected in the Senate’s budget proposal the way those for nuclear power and geothermal were. And it looks unlikely hydrogen will get any love from the Trump administration: In a Senate hearing Wednesday, Energy Secretary Chris Wright said: “It’s tough with the math to see how, in the long term, [hydrogen] becomes a meaningful commercial energy source.”  Speaking to Semafor this week, Pierre-Etienne Franc, CEO of the global hydrogen investment firm Hy24, said he’s also concerned about a proposal in the Big Beautiful Bill, labeled Section 899, to tax foreign investment: The Senate delayed and watered down the proposal, but did not remove it. It all adds up to a difficult investment climate in the US, Franc said, and the firm is pausing any further investment in the US until there’s more clarity on its hydrogen strategy: “We love the US, but there’s a limit.” |

|

New EnergyFossil FuelsTechPolitics & Policy Jon Nazca/File Photo/Reuters Jon Nazca/File Photo/ReutersMinerals & Mining |

|

LaToya Cantrell, mayor of New Orleans.  |

|

|