|

||

| Axios Crypto | ||

| By Brady Dale ·Jun 26, 2025 | ||

|

Good morning. Bitcoin is ticking up out there but the clock is ticking down to summer recess in Congress. Which way crypto policy? Today's newsletter is 1,004 words, a 4-minute read. |

||

| 1 big thing: The SEC X factor | ||

|

||

|

Illustration: Aïda Amer/Axios |

||

|

The crypto industry has a complex political game before it, and is largely split on the best strategy to push to enact the agenda it spent more than $100 million to move in the last election. The big picture: There are three big moving parts on the table, a stablecoin bill that has passed the Senate; an earlier stage bill to create a broader industry regulatory structure; and the SEC's plan to act whether or not any new laws are passed.

Zoom in: Eli Cohen, general counsel for Centrifuge, which puts traditional assets on blockchains, fears that linking stablecoin legislation with a less advanced market structure bill — the name for the broader regulatory legislation — could sink both.

This strategic game is playing out in Washington. The Senate passed its stablecoin bill, GENIUS, which has momentum and political will.

There's support for the House's approach. Some in the industry believe that stablecoin and market structure legislation is so inextricably linked and complementary that it makes sense to move them together — and that it's worth the risk.

If GENIUS was enacted but market structure failed, the SEC could likely provide significant clarity for market participants.

Yes, but: "The SEC could articulate a fit-for-purpose regulatory taxonomy that clarifies the boundaries of securities laws. But any such effort would leave many digital assets outside of the jurisdiction of any regulatory agency," Miles Jennings, the general counsel for venture capital firm A16z crypto, said.

Zoom out: Despite the debate, industry players feel more confident than ever.

The bottom line: Stablecoin legislation looks easy(ish) right now. Market structure looks hard, and Congress' attention span is short. |

||

|

|

||

| 2. California settles with a bitcoin ATM company | ||

|

||

|

Illustration: Aïda Amer/Axios |

||

|

California's financial overseer inked a $300,000 settlement with bitcoin ATM operator Coinme this week, over charges the company failed to comply with the state's rules for operating the kiosks. Why it matters: States have been cracking down on the machines (as we told you Tuesday), which give fraudsters an easy way to get paid by victims of cyber crime. Follow the money: About a 1/6 of the fine will go to a victim who lost over $50,000. The rest will go to the state. Details: Coinme was fined for failing to limit customers to $1,000 worth of transactions each day. It also did not include the name of the exchange used to determine its prices on the receipt, as the state's law requires.

Flashback: California's Digital Financial Assets Law was signed by the governor in October 2023. |

||

|

|

||

| 3. Crypto counts for home loans (soon) | ||

|

||

|

Illustration: Sarah Grillo/Axios |

||

|

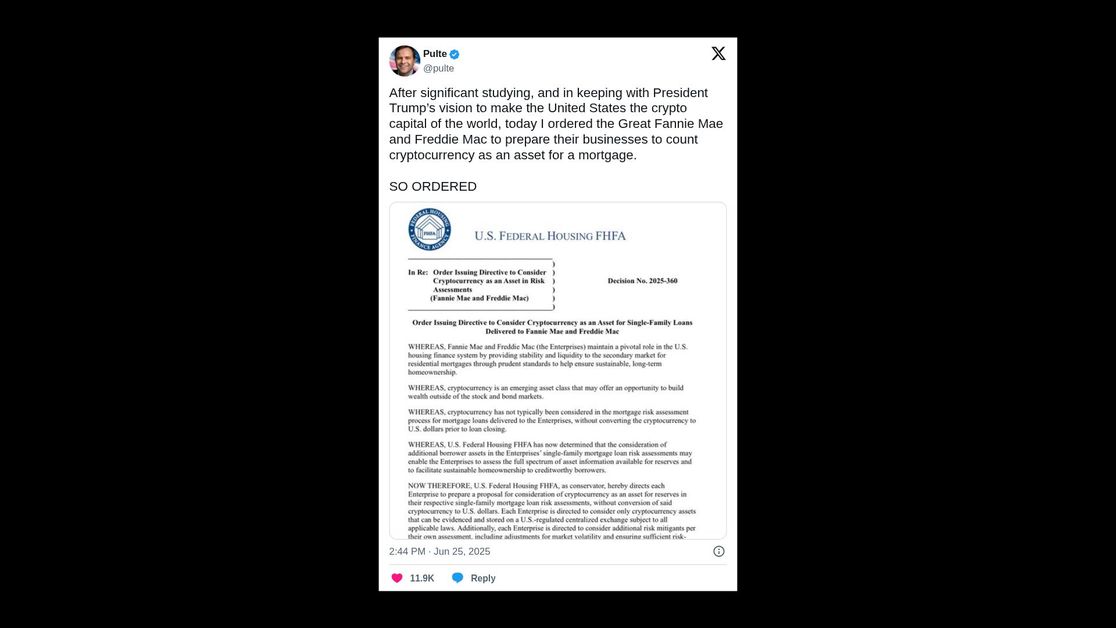

The crypto rich will soon be able to include their digital asset holdings as part of their wealth when seeking a home loan. Why it matters: The housing market has been the main avenue for building wealth for normal Americans for a long time, but it looks shaky today. The latest: Wednesday, the director of the Federal Home Finance Administration, William Pulte, told Fannie and Freddie, the mortgage giants, to bring proposals to consider digital asset wealth when making decisions about loans, according to a post on social media. What they're saying: "In keeping with President Trump's vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage," Pulte wrote.  Screenshot: @pulte/X Background: Reserves are assets that a lender can consider accessible for borrowers should they have a loss of income. State of play: As it stands, digital assets can only be considered if they have been converted to cash bank deposits.

What we're watching: When and how Fannie and Freddie come down on considering such assets.

What's next: There's no timeline for making their proposals, but the order says they should be completed as soon as "reasonably possible." |

||

|

|

||

|

A message from Axios |

||

| Your guide to navigating the ad industry | ||

|

||

|

Coming soon: Axios' exclusive members-only Ad Economics Report. Get expert insights from Sara Fischer and Kerry Flynn on the biggest shifts across platforms, companies, and media — plus the trends shaping what's next. A must-read for media pros. |