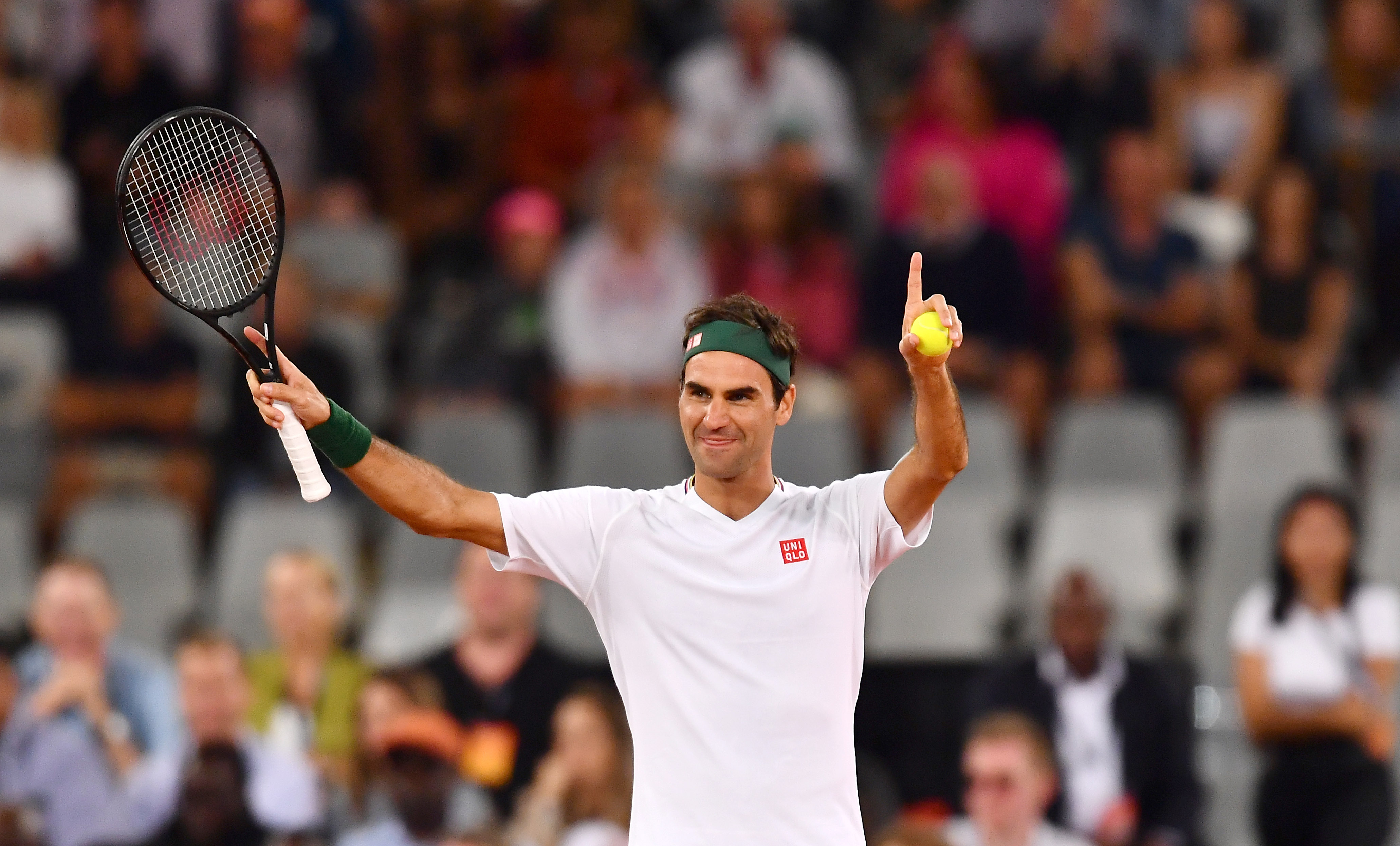

| Hey, it’s Giles and Dylan. During his Dartmouth commencement address last year, Roger Federer complained about the word “retire.” He’d just stopped playing professional tennis, and was now “figuring out” what to do next. Luckily, the older Federer has gotten, the better he’s become at making money, not always a given for top athletes. After officially retiring in 2022, the Swiss sports star is now one of the few pro-sportspeople who can now count themselves a billionaire.  Roger Federer has amassed a $1.3 billion fortune with a mix of endorsements, tennis winnings and investments. Photographer: Gallo Images/Getty Images Federer, who won 20 Grand Slams between 2003 and 2018, amassed $130.6 million in prize money during his 24-year career. But the bulk of his wealth has come via a series of bumper sponsorship deals, alongside an astute investment in a local sneaker brand. Federer’s net worth is about $1.3 billion, according to the Bloomberg Billionaires Index, making him one of the few athletes to reach the milestone. After the sale of his stake in the Charlotte Hornets in 2023, basketball’s Michael Jordan net worth hit an estimated $3.5 billion, while last year Bloomberg calculated Tiger Woods’ wealth at about $1.36 billion. Bloomberg's valuation takes into account Federer's career earnings, investments and endorsement deals, adjusted for prevailing Swiss tax rates and market performance. Sources close to him say he’s worth considerably more than $1 billion. (Bit of trivia: There is an argument Federer is not the first ever pro-tennis billionaire. That honor might go to Ion Țiriac — the Brașov Bulldozer — a Romanian professional from 1958 to 1979, who also played a bit of ice hockey and founded the first private bank in post-Communist Romania.) Many of Federer’s deals have lasted over decades, from sponsorships with Credit Suisse (now UBS) to Lindt chocolate. Federer has also built a close advice network around him, including through Team8, the management company he co-founded with longtime agent Tony Godsick in 2013, and also Swiss firm Format A AG, which helps manage various investments and his charitable foundation. “Federer is totally scandal free. He never says the wrong thing,” said Bob Dorfman, sports analyst. “He hasn’t been a John McEnroe, feisty personality, type. But in terms of marketability, he’s been one of tennis’s best.” After turning professional in 1998, he began sporadically collecting sponsorships, including Nike and watch maker Maurice Lacroix. During the early 2000s, Federer had a multi-year deal with Swiss milk processor Emmi, to promote its performance drink Lacto Tab, based on milk serum. He even rolled out a short-lived cosmetics line. His career took off in 2003 when he won his first Grand Slam singles title at Wimbledon. The next year, he won three more, becoming the first person to do so in a single season since Mats Wilander in 1988. The titles kept on coming. The money wasn’t so easy to get. In 2006, his sponsorships and winnings totaled $14 million, about half of then 35-year-old Andre Agassi. His Nike contract was reportedly far lower than those of his rivals. Women’s tennis star Maria Sharapova, also represented by IMG, was earning about $20 million off the court. While Federer’s sponsorships steadily increased in size, the biggest clothing deal came near the end of his career. By 2018, a rolling contract with Nike, first signed in 1996, had come up for renewal. Tennis was not a core market for Nike, allowing Godsick to test the water with other potential partners. Uniqlo, a popular Japanese brand, offered Federer $300 million over 10 years, to become one of its flagship sports icons. Federer was 37, and close to retirement. The Uniqlo deal had no strings attached, even if he stopped playing. It was a no-brainer.  Oh look, it’s Roger Federer wearing Rolex Land-Dweller 40. Photographer: Anthony Blasko/Rolex The bumper Uniqlo deal wasn’t Federer’s most successful deal. This was an investment that came via an accidental introduction by his wife, who bought a pair of sneakers from up-and-coming Swiss brand On. There are plenty of bankers and lawyers in Switzerland, but not many sports brands. Founded in 2010, On had become known as a high-end jogging shoe. Its distinctive sole, with more empty space than rubber, was based off a prototype made by co-founder Olivier Bernhard — a former pro-Ironman — taping offcuts of garden hose to the base of his trainers. Unlike Federer’s previous Nike deal, Uniqlo doesn’t make shoes, leaving Federer free to hunt for a footwear sponsor. A sneaker nut, who owns well over 250 pairs of trainers (not including the ones he played in), Federer called the On founders for dinner in Zurich. Godsick also had a connection with the founders via an earlier angel investment in the firm. Eventually, a deal was struck. Federer would invest in On for roughly 3% stake and spend time in On’s lab designing his own shoe. On is now worth close to $17 billion, making Federer’s stake at least $500 million, according to Bloomberg's Billionaire's Index. Federer is clearly enjoying his retirement and has focused on his investments. Team8 has been moving away from representing players and refocusing on its investment portfolio and the Laver Cup, a team-based tennis tournament it launched in 2017, after tennis stars Coco Gauff and Ben Shelton left the firm in recent months. Federer has so far avoided overexposure via taking commentary roles or dubious sponsorships. He recently has waved the French flag to start the Le Mans race under way in June, and launched a new clothing collection in Paris with Uniqlo. He’ll also likely be at Wimbledon — home to his greatest triumphs — when it begins next week. |