|

I’m Jonathan Levin, and this is Bloomberg Opinion Today, a compendium of Bloomberg Opinion’s opinions. You may not like this newsletter on an emotional level, but conventional statistics indicate that it is very good. Sign up here.

- When the economy is good but feels bad.

- AI and the future of law firms.

- Risks around the Fed outlook.

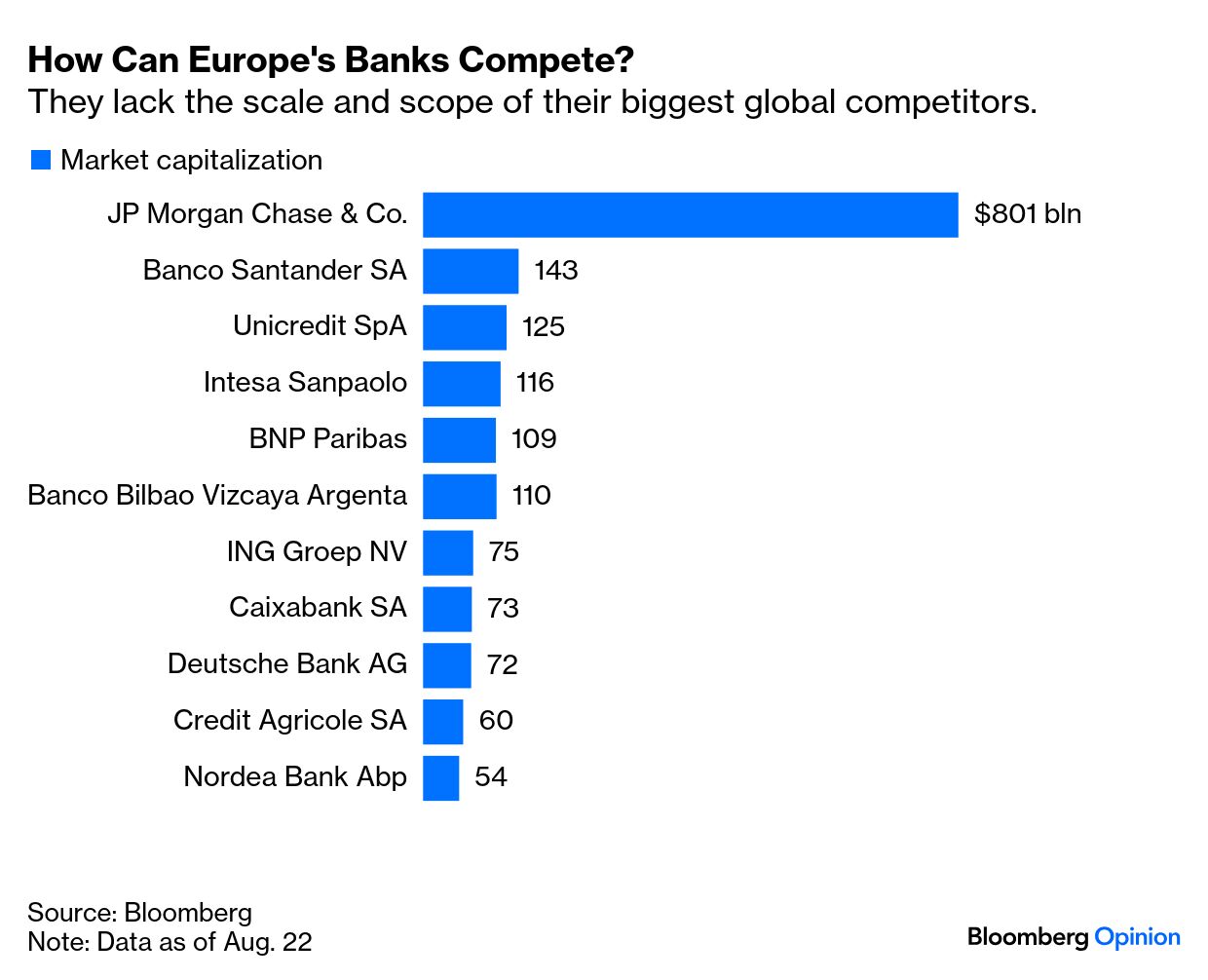

The US economy is still in pretty good shape. The unemployment rate is low and gross domestic product expanded at a 3.3% percent annualized pace in the second quarter. Yet Americans don’t exactly see it that way, and the nagging question is… why? Five years into an epic economic and stock market boom, why is everyone so negative? One piece of the puzzle is inflation. Although it’s cooled off, the inflation rate remains a bit above pre-pandemic norms, and the level of prices itself is quite a bit higher, as Allison Schrager writes. Having lived without serious inflation for decades, that’s left Americans feeling uncertain and off balance. And that uncertainty extends into other aspects of the economy, too. As Allison points out, Americans are also trying to make sense of President Donald Trump’s new approach to global trade and the emerging role of artificial intelligence in the workplace. “AI has emerged as a new force in the economy, increasing the value of the stock market but changing the nature of work and threatening to eliminate jobs,” Allison writes. The legal profession is one such example of the potential upheaval, as Justin Fox writes. Generative artificial intelligence provides the potential— at least theoretically — to replace large numbers of lawyers and disrupt the core business model of law firms based on billable hours. Then again, as Justin notes, “ChatGPT and other LLMs do not confine themselves to existing case law when making legal arguments, often inventing references and quotes instead.” Perhaps partially for that reason, Justin notes that law firms have been laggards in AI adoption. Despite the tremendous threat of disruption, what we have today is an overwhelming sense of uncertainty — and perhaps unease among those with the most at stake. There’s another obvious reason for Americans’ underwhelming reviews of the current US economy: Interest rates are high by the standards of recent history. At around 6.5%, 30-year fixed mortgage rates are still well above the levels that prevailed from 2008 to early 2022. That partially explains why President Trump has been pressuring the Federal Reserve to lower policy rates and trying to push out Fed Governor Lisa Cook to gain more influence on the rate-setting committee. All told, stock and bond markets seem to expect the Fed to cut rates later this month and go further in subsequent meetings. But as I write in my regular column, a meaningful round of rate cuts isn’t as much of a sure thing as the market has come to think – and investors should be careful what they wish for. If the Fed ends up cutting significantly in the near-term, it may well be because the economy appears to be cracking. Alternatively, in the unlikely event that the Fed cuts for the wrong reasons (i.e., under political pressure), the bond market would rebel and push longer-term bond yields and mortgage rates higher — not lower. In other words, there are several ways that this could end badly. And with the market priced for a best-case scenario, the risk is that a disappointing outcome could lead to serious indigestion for both housing and equity markets. As I write in the column, “The market’s lofty expectations for policy easing set the stage for what could be a volatile September.” The European Union desperately needs a competitive banking sector to achieve its goals, and yet the sector is characterized by nationally focused banks that lack the necessary scale and diversification, according to the Editorial Board. As an example, JPMorgan Chase & Co.’s market value is greater than that of Europe’s seven biggest public institutions combined, as the editors write. They call for an EU-wide deposit insurance mechanism to create the conditions for “truly pan-European institutions.”  Denmark’s Orsted A/S is raising 60 billion kroner ($9.4 billion) in a rights offer that would rank among Europe’s largest. Orsted’s unique circumstances aside, Chris Hughes writes that it’s regrettable that companies listed in London and Europe still have to go through this process. The UK and Europe have long thought it was important to give existing investors a right of first refusal before they get diluted in new share sales – which seems fair on the surface. But in practice, the rights offering requirement slows the fundraising process and often precipitates knee-jerk volatility in the relevant stocks anyway, and they may serve as an impediment to equity-financed investment. Intel deal gives Trump a dangerous amount of power. — Joel Michaels Stablecoins will disrupt the credit card business. — Paul J. Davies The rise of strongmen is changing the international system. — Hal Brands Musk keeps cycling through master plans for Tesla. — Liam Denning Investors should be realistic about the Kraft Heinz unwind. — Chris Hughes A top Apple AI researcher is heading to Meta. Anthropic was just valued at $183 billion. A former Goldman worker fired post-paternity leave is seeking £9 million. Creatine supplement demand is up among women. Peter Thiel is hosting Antichrist lectures, and they’re quite in demand. Notes: Please send positive economic vibes and feedback to Jonathan Levin at jlevin20@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |