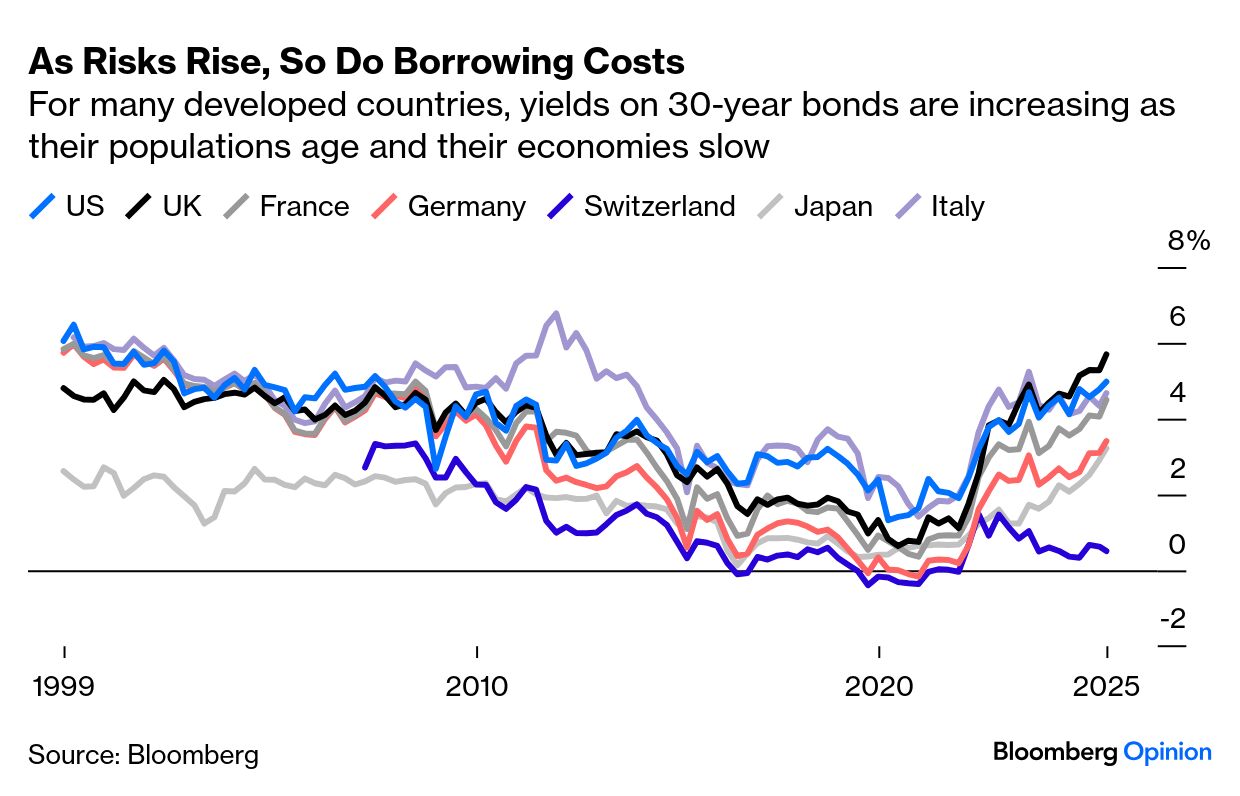

| I’m Justin Fox, and this is Bloomberg Opinion Today, a winning amalgam of Bloomberg Opinion’s popular and unpopular opinions. Sign up here. Trump’s not-so-secret weapon. Bolsonaro’s blunders. Easy SAT questions. English soccer’s money machine. His net approval rating has been underwater since March. He’s presiding over a self-inflicted economic slowdown — and, writes Bill Dudley, reducing the chances of a recession-free “soft landing.” He turns 80 next year, is not in the best of health and is barred by the US Constitution from seeking another term. Yet President Donald Trump isn’t giving off lame-duck vibes at all. Instead, he seems to be having the time of his life, bending the US government to his will in ways he could only have dreamed of during his first term. What’s his second-term secret? According to David M. Drucker, a big part of it is the president’s extreme popularity among Republican voters. The party currently controls all the levers of power in Washington, and Trump has repeatedly demonstrated his willingness to discipline wayward GOP elected officials by supporting their primary opponents. The result: a lot of power — for now at least. Comparisons with the last three two-term presidents are instructive: each had higher overall approval ratings than Trump at this point in their second terms, but markedly lower approval within their own parties. Another factor making second-term life easier for Trump is that while Republicans are likely to lose their majority in the House of Representatives next year, Democrats face long odds in wresting control of the Senate. This is not just because, as is often said, they face a “difficult map” in next year’s midterm elections, observes Ronald Brownstein. The bigger issue is that it’s harder than ever for either party to win Senate seats in states where the other party dominates in presidential elections, and with 25 states voting for Trump in each of the last three presidential elections, Democrats have zero margin for error. Given Trump’s current strength, reading about the current predicament of former Brazilian President Jair Bolsonaro feels a little like a dispatch from Bizarro America (or maybe the above paragraphs are dispatches from Bizarro Brazil). Like Trump, Bolsonaro lost his bid for reelection and encouraged a violent attempt to overturn the result. Unlike Trump, he’s already banned from running again before 2030, and now faces likely conviction and a long prison sentence for coup-plotting. Differences in the two countries’ political and legal systems explain a lot of the difference in outcomes, but JP Spinetto argues that Bolsonaro’s own errors have been decisive. Lacking Trump’s charisma, ideological flexibility and political instincts, he has repeatedly snatched defeat from the jaws of victory. His latest misstep, ironically, has been enlisting Trump to punish Brazil and the judge presiding over his case, alienating both Brazilian voters and … the judge presiding over his case.  | | | The Covid-19 pandemic disrupted education in the US in many ways, and one of the longest-lasting impacts has been on college-admissions testing. Hundreds of colleges and universities dropped the requirement that prospective students take the SAT or ACT, and while there have been some recent high-profile reversals, more than 80% of schools remain test optional. In response, the College Board, the nonprofit that publishes the SAT, is changing the test to increase its appeal, allowing calculator use for the entire math section and replacing the 500- to 700-word passages about which test-takers had to answer a series of questions with 25- to 150-word snippets and answer a single question about each. The College Board claims its research shows the new test to be as rigorous as the old one, but the Bloomberg Editorial Board warns that the reading-comprehension changes in particular could reinforce some dire trends in US education. Young Americans are finding it harder and harder to get through texts of any kind, and now they’ll have less reason to try. When will bond markets finally react to the growing gaps between government revenue and spending in the US and other wealthy nations? The moment may be now. “The 30-year bond yield is rising in almost every rich country, except for those relatively prudent Swiss,” writes Allison Schrager. Yields on shorter-term bonds aren’t sending such a clear signal, and 30-year yields are still low relative to where they were in the 1970s and 1980s, but it does look as if debt markets are emerging from their “decades-long cognitive dissonance.”  The Liverpool Football Club and Athletic Grounds Ltd. spent a staggering £415 million on new players this summer, while taking in £187 million from other teams. Will this big investment pay off? Not in the sense that the club will turn a profit, no. Liverpool did that in 2022, but like most English football clubs it has been in the red since and will certainly be this year. That’s nonetheless OK with lenders and investors, says Paul J. Davies, thanks to the ways in which “the growing reliability and scale of revenue at the biggest teams and franchises” is complementing long-established “vanity and reputation-enhancing aspects of owning famous clubs.” The top English football clubs are now major global media properties, and lenders in particular like working with those. Insurers want to pick your obesity drug. — Lisa Jarvis Nestlé needs a shake-up. — Beth Kowitt Google wins by losing. — Dave Lee US sends a message to Maduro. — James Stavridis UK is smart to go short. — Marcus Ashworth France’s fragility is showing. — Lionel Laurent Trump hands wind industry to China. — David Fickling Modi’s wishful thinking on China. — Mihir Sharma Job openings are lowest in a year. Cracker Barrel’s new logo really did hurt sales. Leo’s Basquiat is selling at a discount. Why buses all come at once. AI startup wants to eliminate crime. How to make houseplants glow in the dark. Notes: Please send easy SAT questions and feedback to Justin Fox at justinfox@bloomberg.net. Sign up here and find us on Bluesky, TikTok, Instagram, LinkedIn and Threads. |