| Read in browser | ||||||||||||

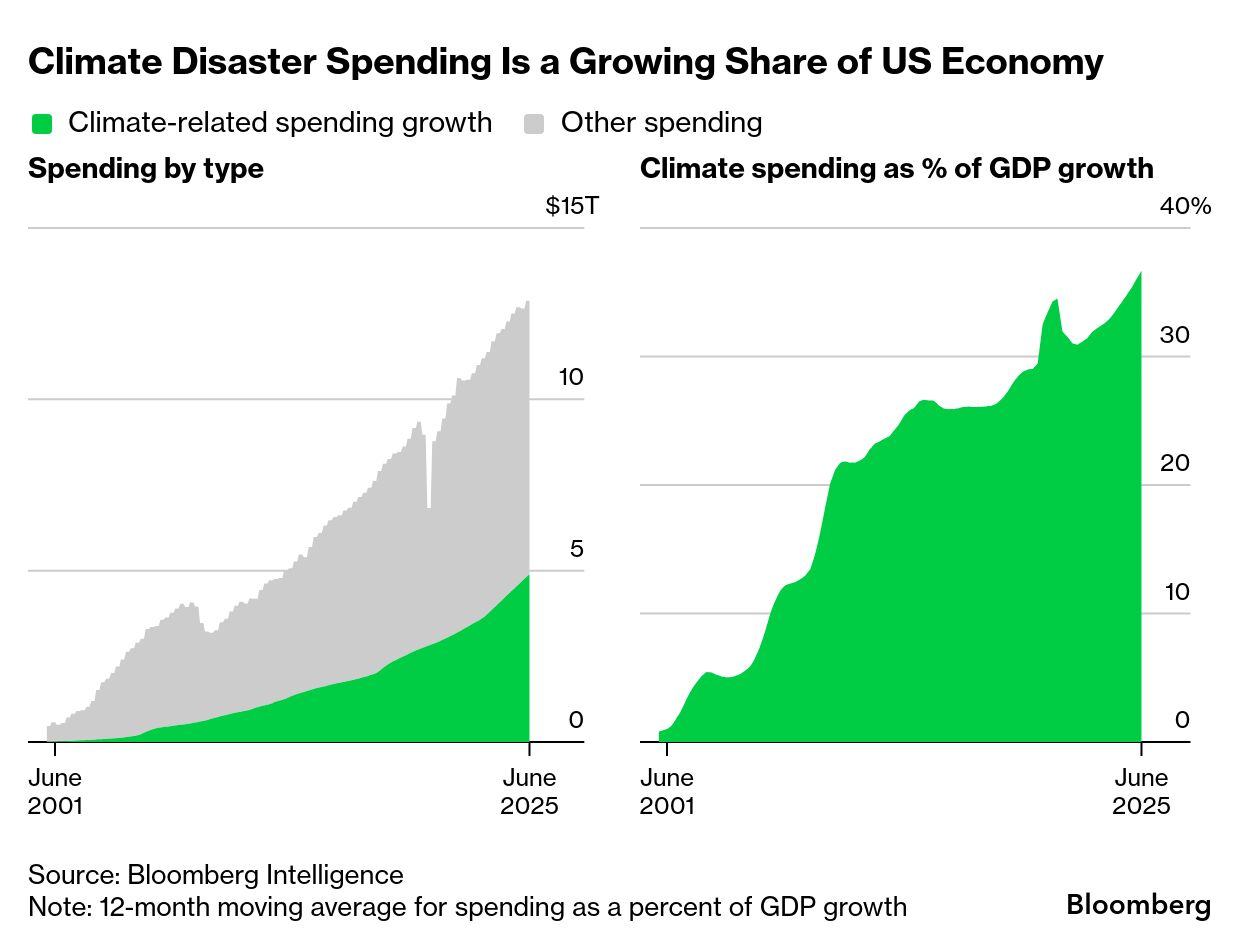

Welcome to Balance of Power, bringing you the latest in global politics. If you haven’t yet, sign up here. It’s not easy being European these days. On one side, the continent is derided by President Donald Trump’s administration and instructed to squeeze China. From the other, Europe has been hit by China’s rare-earth export curbs primarily directed at Washington. Now, it’s fallen foul of another great-power play between the world’s two biggest economies. And yet again, Europe is caught between the two, seemingly powerless. It began with a relatively obscure legal move in the Netherlands, and has transformed in the space of a few days into a threat to jobs and the bottom line for companies across Europe. Last week, the Dutch government unexpectedly seized control of chipmaker Nexperia — a subsidiary of Chinese company Wingtech — citing the need to safeguard strategic production.  Chinese President Xi Jinping and European Commission President Ursula von der Leyen in Paris in May 2024. Photographer: Nathan Laine/Bloomberg At face value, it looked similar to past curbs placed on ASML at the behest of the US to hinder China’s access to the Dutch company’s world-beating chipmaking equipment. Only Nexperia is no ASML; its chips are not cutting-edge, but are widely used in the automotive industry. It transpired the Dutch acted after Washington warned that Nexperia needed to replace its Chinese CEO to qualify for exemption from a US list of sanctioned companies, which Wingtech is on. Beijing reacted with predictable fury, blocking the export of chips made at Nexperia’s Chinese plants — and blaming the Dutch. Blindsided, Europe’s auto industry is now preparing for supply-chain disruptions. Crisis meetings have been called, task forces set up, and urgent channels of communication opened to try and allay the crunch. European leaders already due to discuss China’s restrictive trade measures in Brussels tomorrow are now sure to deliberate on chip curbs, too. The developments bear the hallmark of geopolitical muscle-flexing ahead of Trump’s planned meeting with Xi Jinping next week. Europe, as so often before, is getting squeezed in the middle. — Alan Crawford  A BMW iX3 at the IAA Mobility 2025 expo in Munich on Sept. 8. Photographer: Krisztian Bocsi/Bloomberg Global Must ReadsTrump predicted an upcoming meeting with Xi would yield a “good deal” on trade — while also conceding that the highly anticipated talks at a summit in South Korea this month may not happen. Six months into his trade war, the resilience of Chinese exports is proving just how essential many of its products remain even after US levies of 55%, with about $1 billion of goods crossing the Pacific to the US daily. Russia launched drone and missile strikes on Ukraine, killing at least six people, after Trump told reporters he didn’t want “a wasted meeting” with President Vladimir Putin in the latest sign that a planned second summit could be in jeopardy. European nations are working with Ukraine on a 12-point proposal to end Russia’s war along current battle lines, pushing back against Putin’s renewed demands for Kyiv to surrender territory.  WATCH: Bloomberg’s Greg Sullivan reports on the proposed meeting. US Vice President JD Vance said he remains optimistic about the future of a ceasefire between Israel and Hamas despite a flareup in violence over the weekend, part of a bid to keep talks progressing on the future of Gaza. Meanwhile, the United Nations said Israeli settler violence has “skyrocketed” in the West Bank as extremists once again disrupt the economically crucial olive harvest in Palestinian communities. Infrastructure issues such as a lack of water and overburdened sewers in cities like Cambridge are hindering the UK’s ambitions to overhaul its economy around life sciences. The situation in the university town deters companies and creates risk for developers, touching on struggles ranging from lengthy planning processes holding back renewable energy and key infrastructure to stretched public finances. North Korea fired suspected short-range missiles days before Trump and other heads of state are set to gather in South Korea for the Asia-Pacific Economic Cooperation summit. The launches underscore the persistent threat Pyongyang poses to regional security and appear aimed at seizing the attention of world leaders, particularly the US president, who has floated the idea of meeting Kim Jong Un this year.  A news broadcast showing a North Korean military parade in February 2023. Photographer: Jung Yeon-Je/AFP/Getty Images The US government shutdown has become the second-longest in history as the stalemate over expiring health-care subsidies persists. Trump said Prime Minister Narendra Modi assured him during a call yesterday that India would wind down purchases of Russian oil, a possible reprieve to their trade impasse. Modi acknowledged the call, without mentioning the content of the discussion. Skepticism is growing in Argentina that US Treasury Secretary Scott Bessent can pull off the second half of his $40 billion rescue package with just days before a midterm election in the South American nation. China accused Australia of distorting facts and using inflammatory rhetoric following a mid-air encounter between the nations’ military aircraft and urged Canberra to avoid undermining bilateral ties. Sign up for the Washington Edition newsletter for news from the US capital and watch Balance of Power at 1 and 5 p.m. ET weekdays on Bloomberg Television. Chart of the Day In a US buffeted by extreme weather, disaster spending is becoming a key driver of the economy, with storms like Helene becoming both more frequent and more severe because of climate change. The country spent almost $1 trillion in the 12 months ending in June to repair damage compared with an average closer to $80 billion in current dollars during the 1990s. And FinallyA diamond-encrusted bow that once belonged to Empress Eugénie reached a reported €6.72 million ($7.8 million) the last time it was sold, though what it’s worth now after it was stolen as part of an Ocean’s Eleven-style raid on the Louvre Museum in Paris is much harder to establish. The eight pieces worth an estimated €88 million can’t be sold or worn in public and black markets carry deep discounts. The alternative is that the exquisite jewels — diamonds, emeralds, sapphires — and gold could be broken up or melted down for sale separately.  A French forensics officer examines the cut window at the Louvre Museum on Sunday. Photographer: Kiran Ridley/Getty Images More from Bloomberg

We’re improving your newsletter experience and we’d love your feedback. If something looks off, help us by reporting it here. Follow us You received this message because you are subscribed to Bloomberg’s Balance of Power newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.

|