| | Canada’s leader warns of global order “rupture,” the US seeks new minerals markets, nuclear power ga͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Flagship |  |

| |

|

The World Today |  - Carney warns of ‘rupture’

- Trump NATO concerns

- Anthropic’s chip warning

- China courts US allies

- US seeks minerals supply…

- …and overseas fracking

- US seizes Venezuela tanker

- Nuclear power gathers pace

- Sega cofounder dies

- Publishers’ romantasy boost

A Seoul retrospective of two artists joined by an experience of exile and a love of abstract imagery. |

|

Carney warns of global order ‘rupture’ |

Denis Balibouse/Reuters Denis Balibouse/ReutersCanada’s prime minister argued US aggression and protectionism had triggered a “rupture” in the global order, requiring middle powers such as his to unite — remarks in Davos likely to contrast with an address from the American leader today. Mark Carney’s speech did not explicitly mention US President Donald Trump but clearly focused on him, warning against “using economic integration as weapons, tariffs as leverage, financial infrastructure as coercion, supply chains as vulnerabilities to be exploited.” His comments were largely echoed by France’s president and the head of the European Commission, though Trump seems unfazed: Before heading to Davos, he refused, for example, to rule out using military force to seize Greenland. |

|

US NATO pullback sparks concern |

The head of NATO and Donald Trump. Kevin Lamarque/Reuters The head of NATO and Donald Trump. Kevin Lamarque/ReutersThe US is reportedly planning to partly reduce its participation in NATO, exacerbating worry among alliance members already grappling with Washington’s threats towards Greenland. The shifts will be gradual and have been planned for months, The Washington Post and Financial Times reported. However, their symbolic impact — coming amid a transatlantic crisis over US President Donald Trump’s call to annex Greenland, and disagreement over supporting Ukraine — is significant. A senior Time journalist contrasted the Trump administration’s approach with that of George W. Bush in the aftermath of the 9/11 terror attacks: “Unlike that stretch of norm testing, Washington is not leaning on the decades-old alliance of NATO but rather seems intent on destroying it from within.” |

|

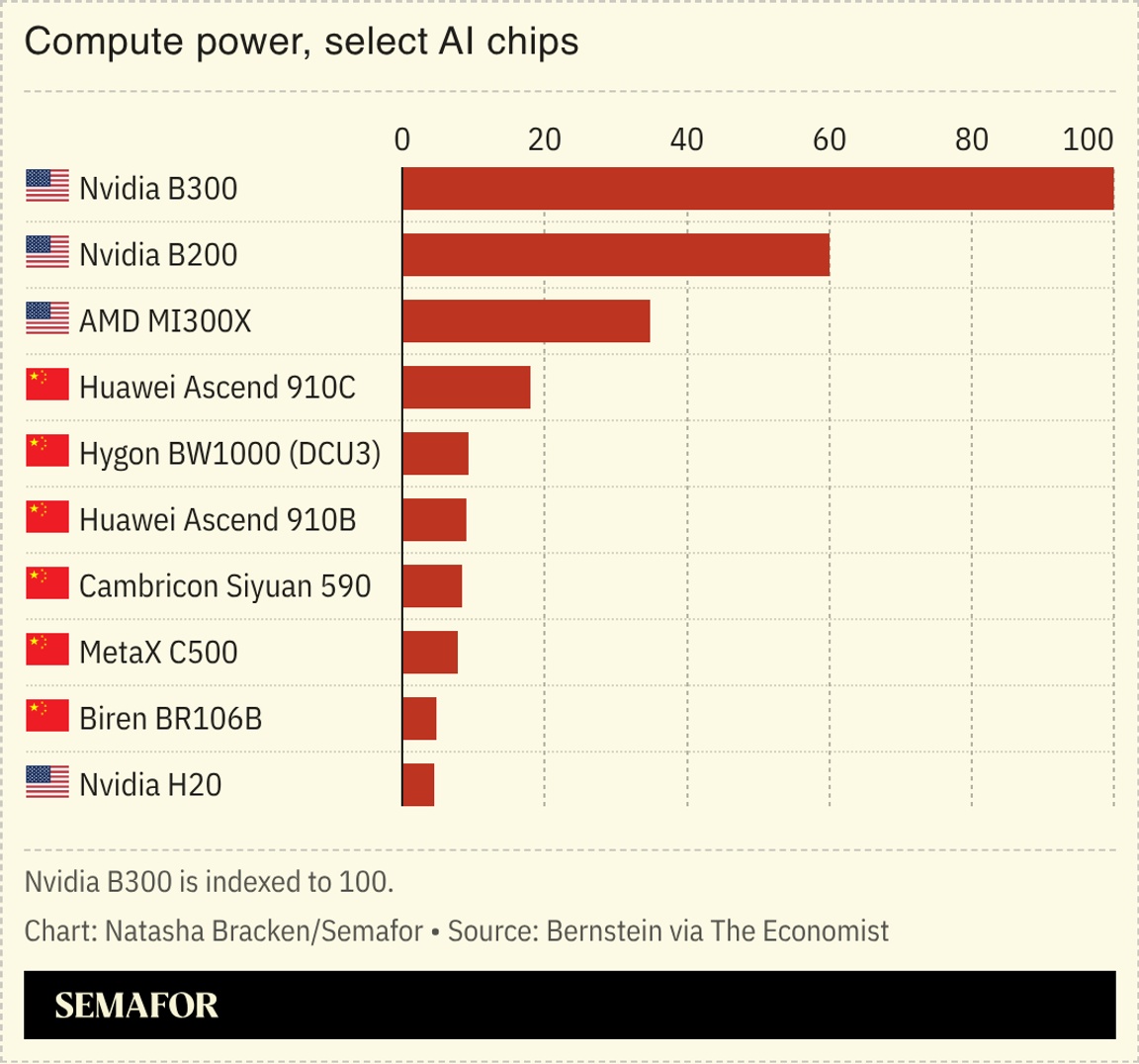

Anthropic warns on chip sales to China |

Anthropic CEO Dario Amodei equated Washington’s decision to allow Nvidia to manufacture AI chips for China with “selling nuclear weapons to North Korea.” Speaking at the World Economic Forum, the head of the AI giant told Bloomberg that the US is “many years ahead of China” in chipmaking ability, but that the move by Nvidia — a major Anthropic investor — and the Trump administration was “crazy,” and had “incredible national security implications.” There are two summits underway in Davos, Semafor’s Reed Albergotti reported: One geopolitics-focused, centered on “Greenland, Venezuela, and the rewriting of the world order,” and the other a high-end tech conference of dealmaking and selling. Amodei’s comments are a reminder that the two sides remain strongly linked. |

|

The UK and China want to revive a “golden era” of business dialogue when their leaders meet in Beijing next week, part of Chinese leader Xi Jinping’s push to court longtime US allies frustrated by Washington. British Prime Minister Keir Starmer’s visit follows a trip by Canada’s leader to Beijing to sign several new trade agreements. Germany’s chancellor is also set to visit next month. All three nations have faced tariff threats from Washington, and worry about the Trump administration’s threats towards NATO. Yet, warming to Beijing is a tricky alternative: “Frustrations with one American president need not give way to the agenda of dictators,” The Washington Post’s editorial board wrote. |

|

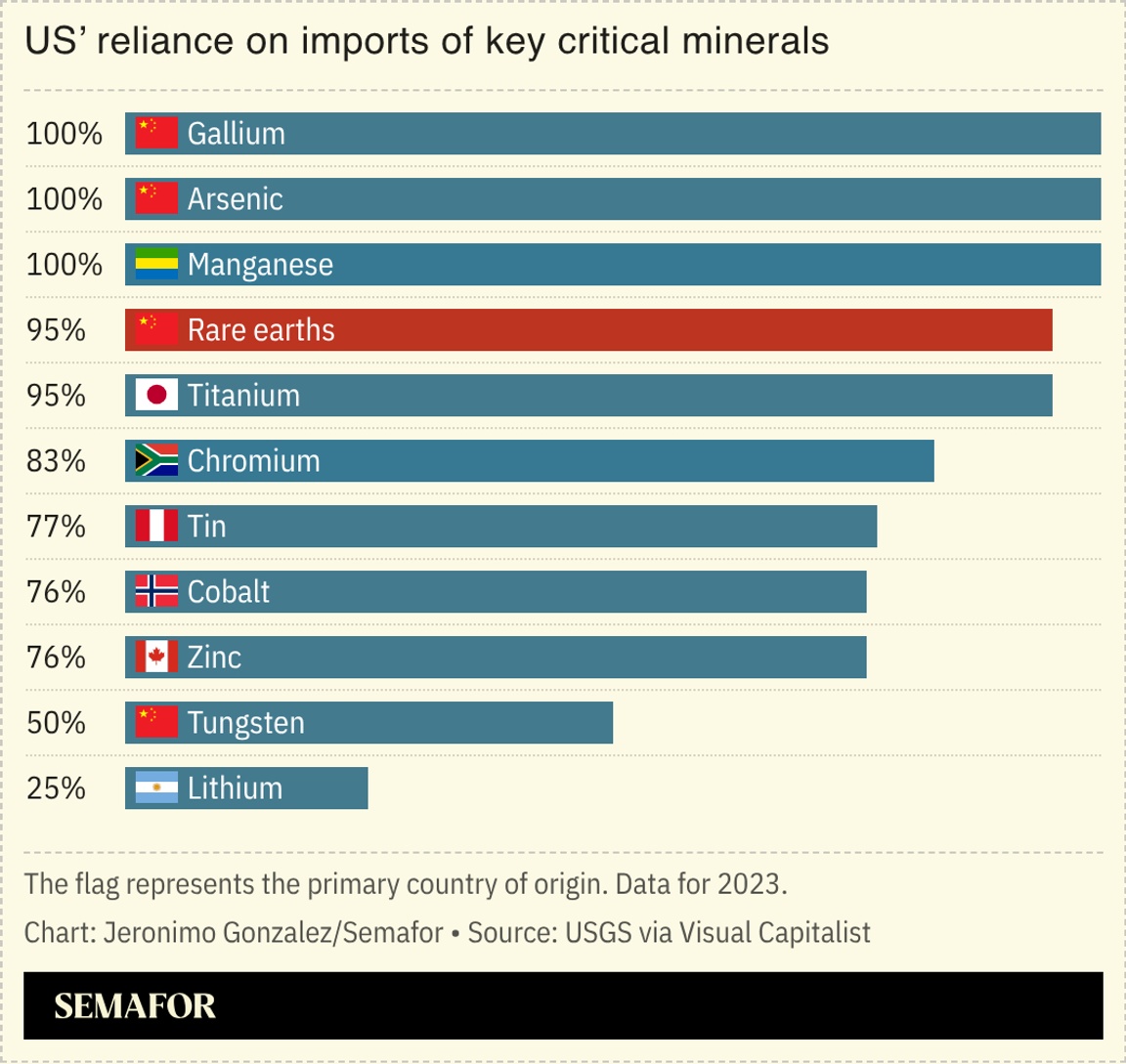

US eyes new mineral markets |

The US is looking to Australia and Africa for minerals in an attempt to sidestep Chinese restrictions. The US uranium group Energy Fuels will buy an Australian miner for $300 million, the latest deal involving the two countries since Beijing briefly placed export controls on refined rare earths last year; Washington and Canberra have also agreed to each invest $1 billion in mining projects to bolster supply chains. The Democratic Republic of Congo, meanwhile, offered the US access to an array of state-owned mining projects, producing cobalt, copper, gold, lithium, and manganese in exchange for development investment and security guarantees, Reuters reported. The move would reduce US reliance on Chinese-controlled mineral processing. |

|

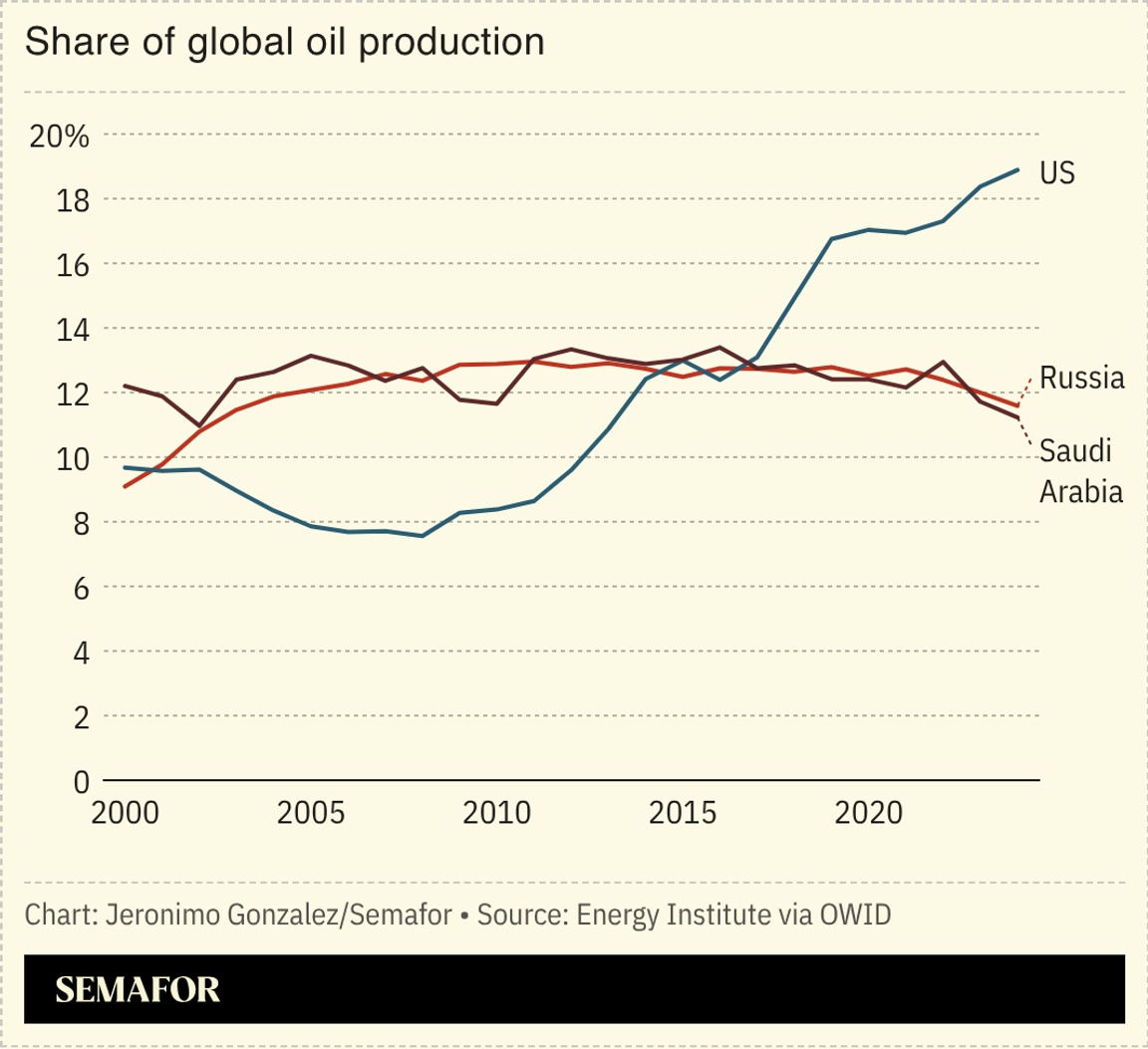

US shale production set to plateau |

A plateauing shale boom in the US is pushing domestic firms to seek opportunities in new markets such as Australia and Venezuela in a bid to boost crude production. Beginning in the early 2000s, hydraulic fracking helped make the US the world’s biggest producer of oil and gas, reducing its dependence on imports. However, growth appears to be slowing: The US Energy Information Administration predicted output will flatten this year and fall in 2027. Though US President Donald Trump has vowed to expand domestic capacity, falling oil prices and rising costs mean producers will struggle to break even, while the logistical challenges for shale drillers operating abroad remain substantial. |

|

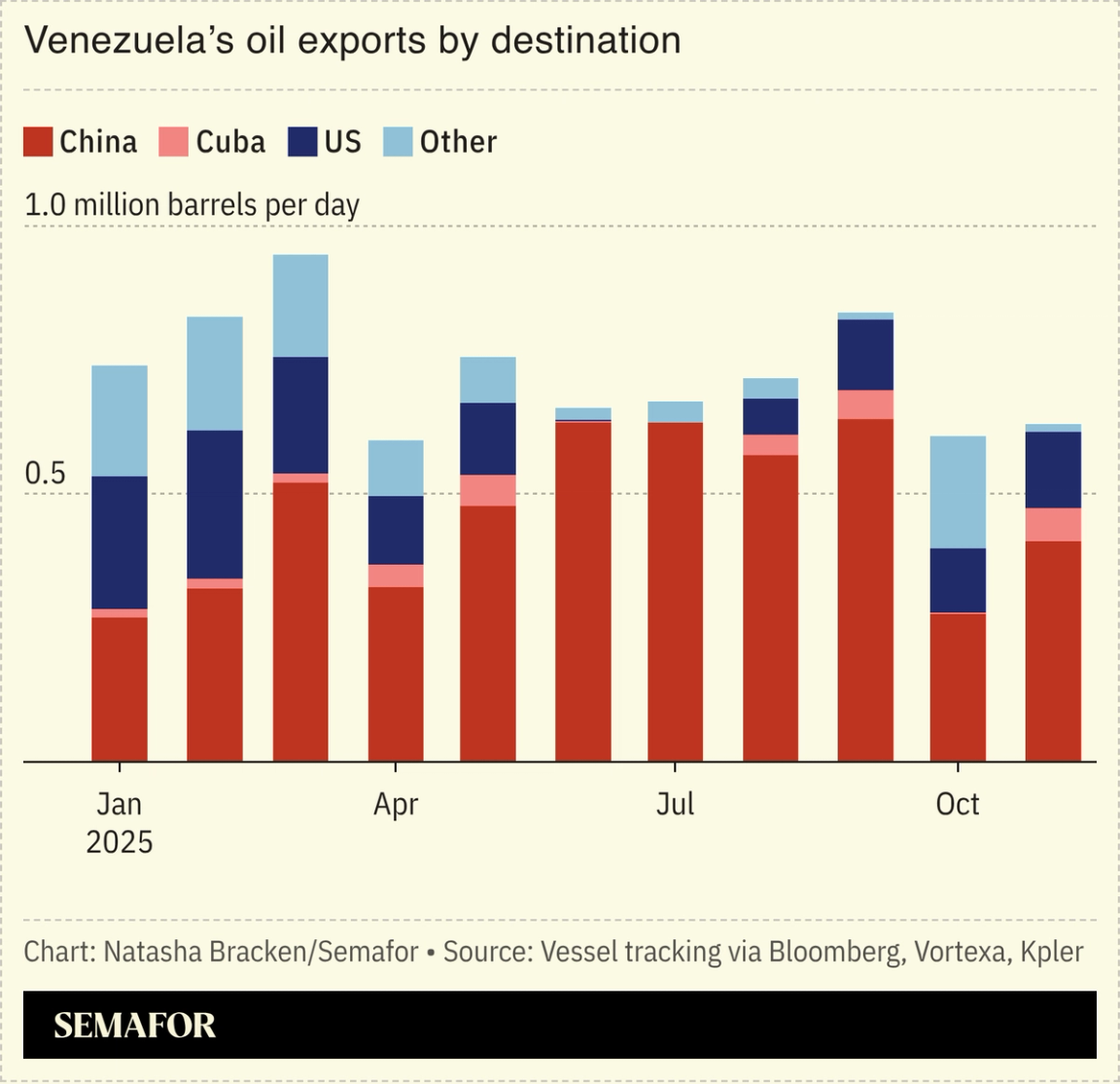

US seizes another Venezuela tanker |

The US seized a seventh Venezuela-linked oil tanker, further consolidating its control over the Latin American nation’s crude industry. Since ousting former President Nicolás Maduro, Washington has tightened its authority over Venezuela, selling its oil abroad — US President Donald Trump said Tuesday his country had taken 50 million barrels out of the country — and was instrumental in pushing Caracas to ease its foreign investment rules in order to lure international energy companies. Both the Venezuelan regime and the opposition have become reliant on Trump’s directives: Caracas confirmed the first proceeds of a US crude sale helped prop up the bolívar, while Trump said yesterday he was considering giving opposition leader María Corina Machado a role in determining Venezuela’s future. |

|

Mustafa Suleyman, CEO of Microsoft AI, is joining the Semafor World Economy Global Advisory Board, a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals, an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open here. |

|

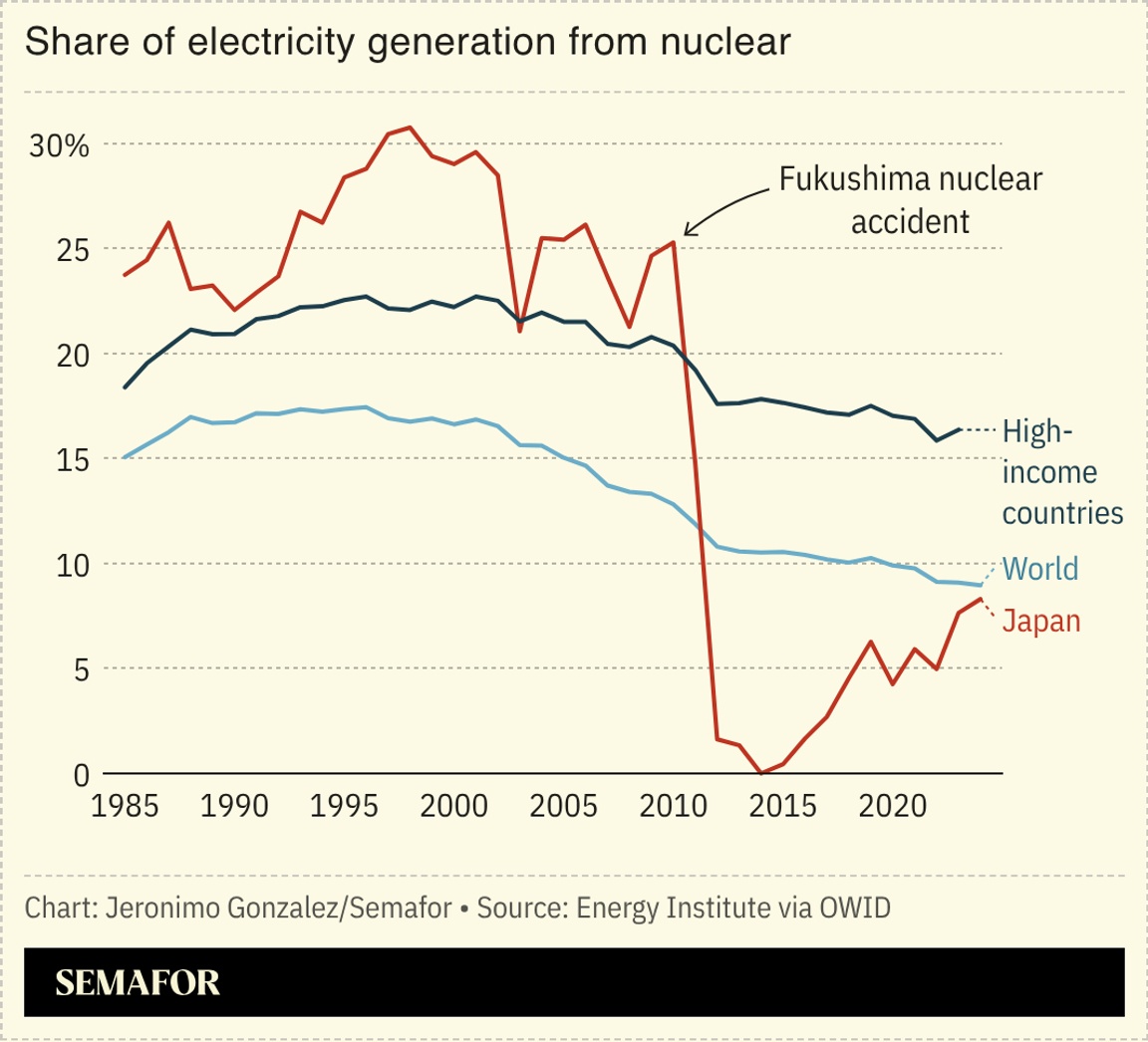

Nuclear power gathers pace globally |

The global dash to reboot the nuclear power industry accelerated. Britain moved to extend the life of a major reactor by 20 years, seeking to bridge a multi-year gap between its older generation facilities retiring and new ones opening, and Japan’s Kashiwazaki-Kariwa plant, the world’s largest, restarts operations today after 15 years. Building new nuclear sites faces political and regulatory hurdles: France’s EDF churned out dozens in the 1980s, taking just six years for each. Its most recent took 16 years, and the company is turning to China to relearn “nimble construction,” the Financial Times reported. The Chinese industry has no such problems: It is constructing 35 units, each expected to take about five years. The US is building zero. |

|

Influential Sega cofounder dies |

David Rosen, the cofounder of Sega, died aged 95. Born in New York City, Rosen started a photobooth company while serving with the US Air Force in Japan in 1954; it merged with a s |

|

|