|

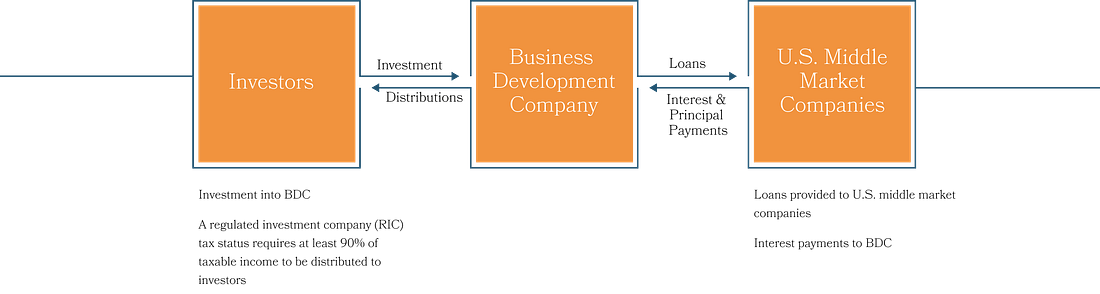

Business Development Companies (BDCs) are interesting because of their high yields and because they’re an easy way to invest in private credit.

But what exactly is a BDC, and how do you invest in the right ones?

Let's teach you everything you need to know.

What is a Business Development Company?

You can think of a BDC as a bank for private companies.

For a small business to grow, they need cash.

But they often can't get loans from big banks because they’re too small or too risky.

BDCs lend money to these firms so they can expand.

How do BDCs Make Money?

A BDC makes money in a few simple ways.

1. Interest Spreads

BDCs borrow money at a low cost and lend it out at a higher rate. The difference between what they pay and what they earn is called the spread.

2. Interest Income

Most BDCs focus on loans. When a private company borrows from a BDC, they pay interest every month. A lot of these loans have rates that go up when the Fed raises rates. This means the BDC earns more when interest rates are high.

3. Equity

Sometimes, a BDC will also take a small piece of ownership (stock) in the company. If that company grows and gets sold, the BDC makes profit on its ownership.

4. Fees

BDCs charge the companies they help for things like setting up the loan or giving business advice.

Types of Loans

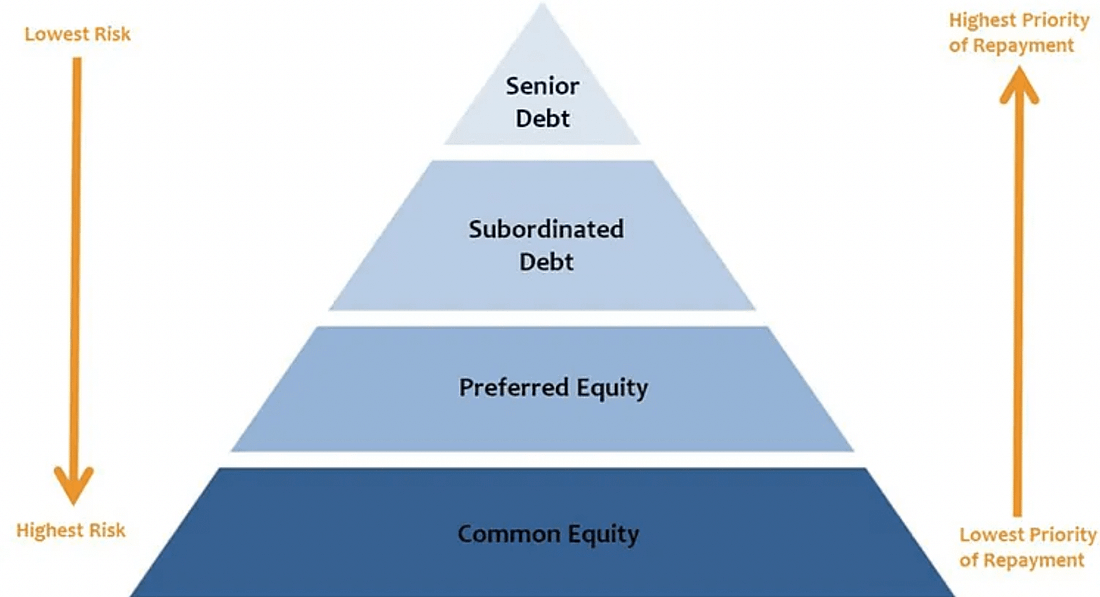

Because a BDC is mainly a lender, it’s important to understand the different types of loans they can make.

First lien secured loans (Senior Debt) – loans backed by the borrower’s assets. These are the first loans that must be repaid if the business fails.

Second lien or mezzanine loans (Junior Debt) – higher risk debt, paid out after the first lien loans that come with higher interest rates.

Unitranche loans – a blend of senior and junior debt in a single package.

The main thing to understand is that the senior debt gets the highest priority of repayment, making it lower risk and usually lower interest rates.

The further down you go in the capital stack, the lower your priority of repayment, but the higher the potential rewards become.

Business Development Companies often create a portfolio of different types of credit and equity to create diversification.

Let’s look at an example of a BDC’s portfolio.

I’ve used Ares Capital Corporation because they’re a very large and diverse BDC.

They own:

A lot of secured loans

Some second lien and subordinated loans

A bit of preferred and common equity