| | In this edition: Nigeria’s Paystack enters banking, new AI fund for Africa health care, gender gap i͏ ͏ ͏ ͏ ͏ ͏ |

| |  | Africa |  |

| |

|

- DRC offers US mineral assets

- Paystack enters banking

- $1B in climate funding

- $50M for AI-health fund

- Malawi hikes fuel prices

- Gender gap in private capital

Kinshasa’s central market is set to reopen after a revamp. |

|

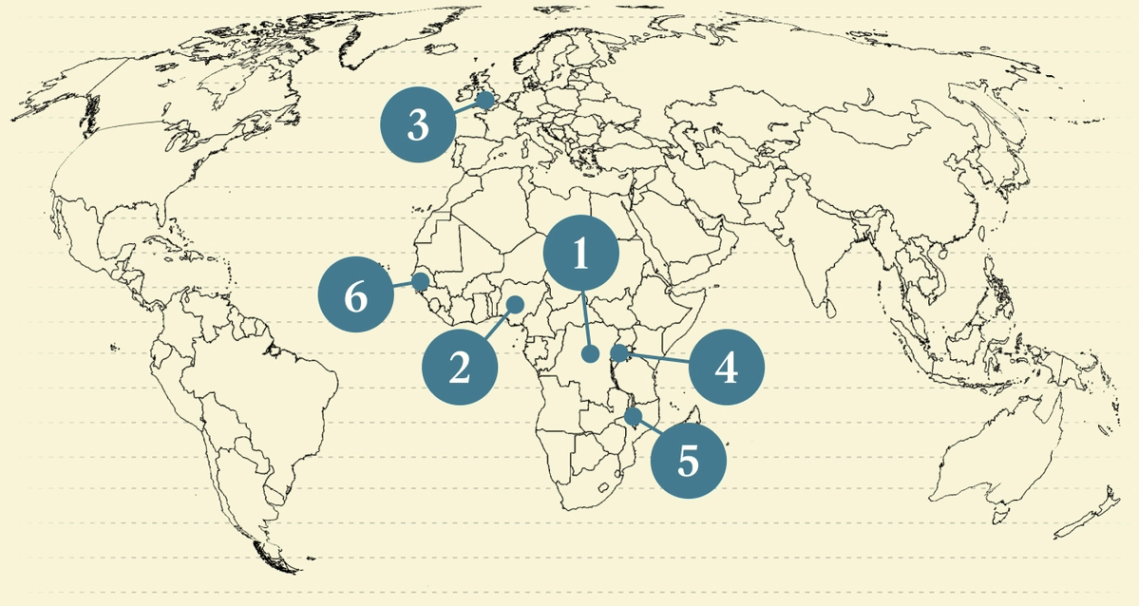

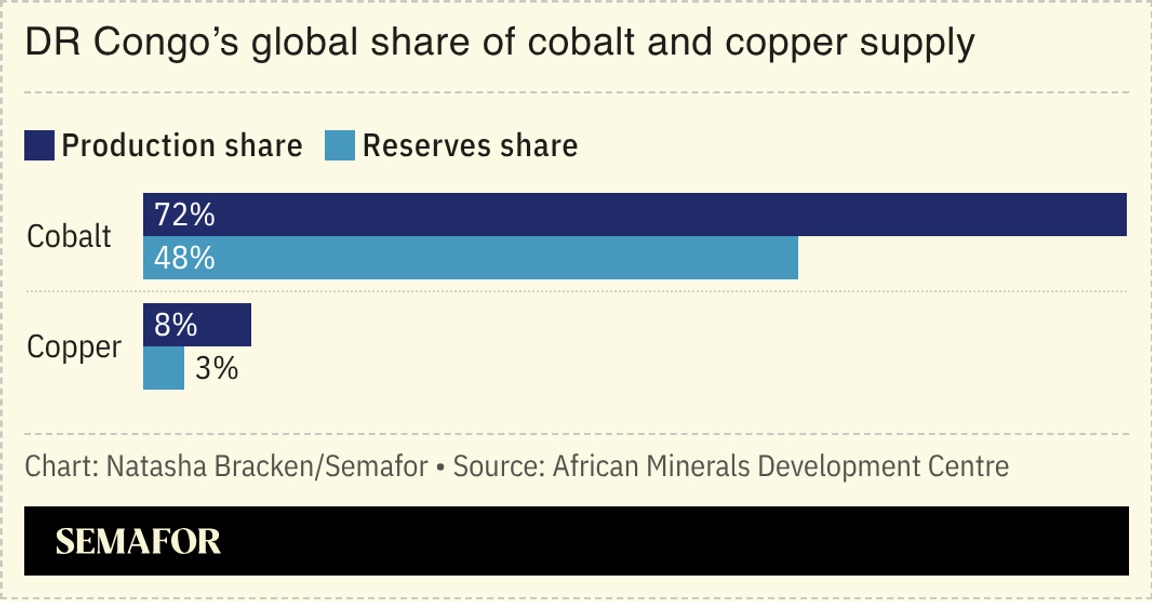

DR Congo offers US minerals shortlist |

Kinshasa has sent the US a shortlist of state-owned assets that American investors can consider as part of a minerals pact, DR Congo officials told Reuters. The list — which covers cobalt, copper, gold, lithium, and manganese mining projects — marks Kinshasa’s most direct offer to Washington so far, they said. In return, DR Congo is seeking development investment and security guarantees from the US. The partnership comes at a time when Washington is trying to end its reliance on Chinese-controlled mineral-processing. The Trump administration has accelerated efforts to secure its own supply chains, brokering a peace deal last year between DR Congo and neighboring Rwanda — though fighting has persisted in the former’s eastern region. Washington and Canberra have also agreed to each invest $1 billion in mining projects to bolster mineral supply chains. |

|

Paystack eyes growth beyond payments |

| |  | Alexis Akwagyiram |

| |

Paystack CEO Shola Akinlade. Dave Kotinsky/Getty Images for Semafor. Paystack CEO Shola Akinlade. Dave Kotinsky/Getty Images for Semafor.Nigerian payments processor Paystack is expanding into banking and consumer finance to provide financial services to African businesses, its CEO told Semafor. It has launched a new parent holding company, The Stack Group, to operate Paystack, alongside its new money transfer service, a microfinance bank, and a research and development division. The move comes five years after US fintech giant Stripe acquired Paystack for $200 million. Paystack — which has expanded into Côte d’Ivoire, Ghana, Kenya, and South Africa, after launching in Lagos in 2016 — is entering an increasingly crowded market. Several companies, such as Flutterwave, Moniepoint, and OPay, have launched digital banking services in recent years, particularly in the continent’s most populous nation, Nigeria. About 42% of adults in sub-Saharan Africa are unbanked, creating a major growth opportunity for companies offering financial services. Digital infrastructure needed for faster connections is improving, while handsets are becoming cheaper, and rapid population growth in Africa is increasing the number of new consumers quicker than in other parts of the world. |

|

The size of a fund launched this week for climate finance in emerging markets. Around 40% of the Allianz Credit Emerging Markets fund will be deployed into ventures and programs in renewable energy, agriculture, and transportation in Africa, according to the UK’s British International Investment (BII) agency, which is the fund’s anchor investor. Africa needs about $3 trillion to adapt to, and mitigate against, the effects of climate change. The ACE fund, which has so far secured $690 million in commitments, comes at a time when the US has pulled back on climate finance. But the UK has sought to expand its role in the sector, with BII pledging last year to ensure that at least 30% of its new commitments will be in climate finance. |

|

| |  | Yinka Adegoke |

| |

Gavi/2019/Tony Noel via Reuters Gavi/2019/Tony Noel via ReutersThe Gates Foundation and OpenAI unveiled a $50 million partnership to deploy artificial intelligence tools across health care systems in several African countries, beginning in Rwanda. The initiative, called Horizon1000, aims to reach 1,000 primary health care clinics and surrounding communities by 2028. The program, which will help African nations to integrate AI into their health infrastructure, comes roughly a year after the Trump administration shut down USAID and other Western countries also slashed their foreign aid programs. The cuts have prompted major donors like the Gates Foundation to seek alternative approaches promising greater efficiency with fewer resources, though whether AI tools can compensate for reduced traditional aid remains untested. The Gates Foundation provides financial support for Semafor’s Next 3 Billion series. |

|

Levent Çakıroğlu, CEO, Koç Holding AS, is joining the Semafor World Economy Global Advisory Board — a forum of visionary business leaders guiding the largest gathering of global CEOs in the US. The expanded board represents nearly every sector across the US and G20. Joining the Advisory Board at this year’s convening will be our inaugural cohort of Semafor World Economy Principals — an editorially curated community of innovators, policymakers, and changemakers shaping the new world economy with front-row access to Semafor’s world-class journalism, meaningful opportunities for dialogue, and touchpoints designed for connection-building. Applications are now open. |

|

Eldson Chagara/File Photo/Reuters Eldson Chagara/File Photo/ReutersMalawi increased petrol and diesel prices by more than 40% to reduce pressure on foreign currency reserves in a move that looks set to deepen a cost-of-living crisis. Authorities said the prices will change in line with the cost of fuel imports, replacing an “unsustainable” fixed pricing system. The hike — the second in four months — is likely to increase the cost of key services and goods, such as transport and food. Malawians have in recent years grappled with annual inflation that has hovered at around 30%. President Peter Mutharika, who returned to power in October after vowing to revive the country’s ailing economy, is trying to improve the government’s finances as the country negotiates a new IMF support package. Lilongwe agreed a $175 million loan from the lender in 2023 to restore economic stability after the COVID-19 pandemic exacerbated repayment pressures. But the loan deal was suspended last year. |

|

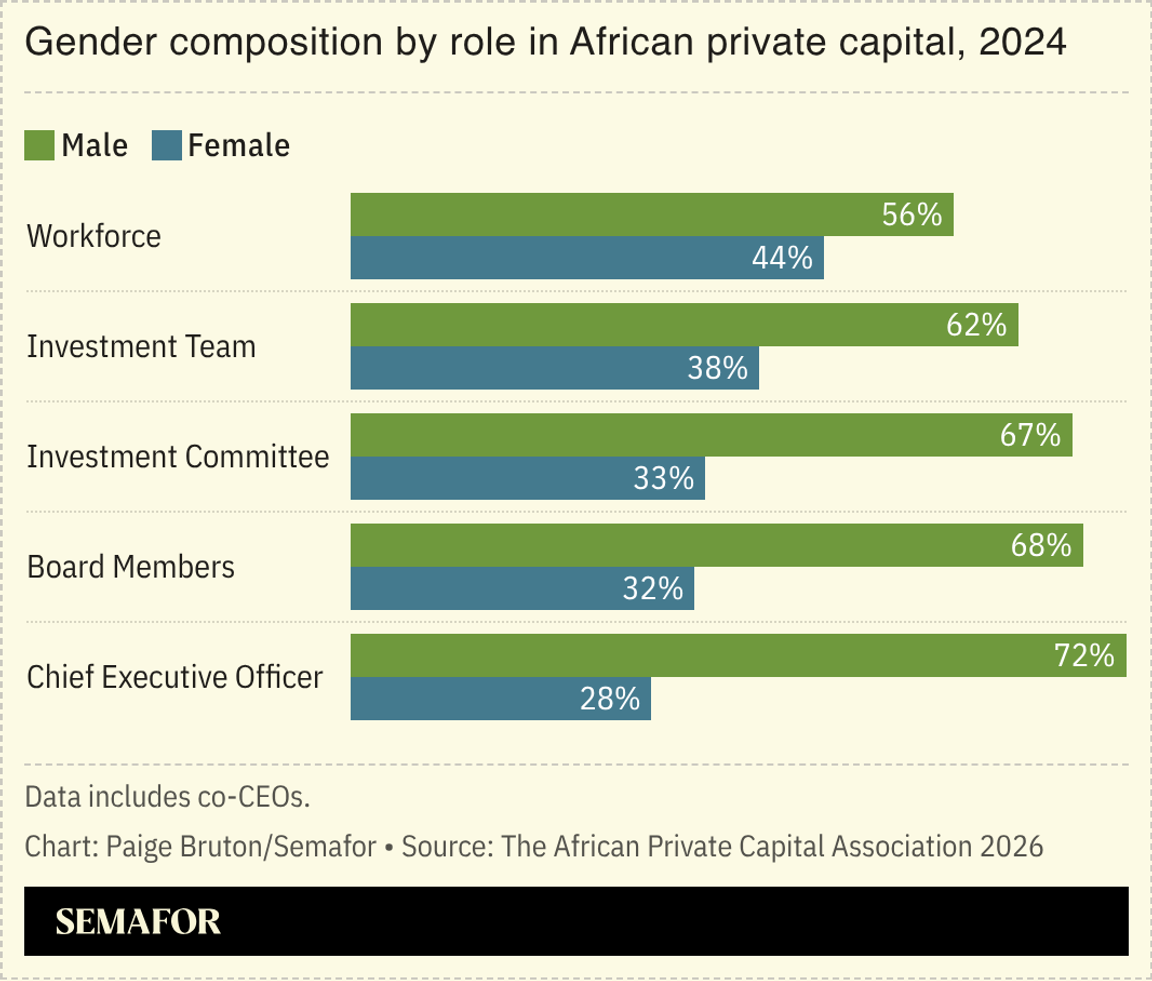

Calls to boost female leadership |

Africa’s private capital industry outperforms global peers in gender representation, but larger companies are lagging in efforts to boost female leadership, a new report argued. At firms where most of the partners are women, 48% of the companies they invest in are led by women, compared to just 8% at male-dominated ones, according to The African Private Capital Association. And only 7% of companies backed by private capital in the continent are founded by women. The research showed that smaller investment firms are typically more inclusive than larger ones, where women are significantly underrepresented in portfolio company leadership. The report suggested that narrowing the gender gap in top roles could boost financial performance: On average, female-led companies saw a 32% increase in revenue from 2023 to 2024, while male-led teams saw 14% revenue growth during the same period. — Alexander Onukwue |

|

Business & Macro |

|

|