|

|

Hey Friend,

While everyone's arguing about Iran tariffs, $55 billion just moved...

Into a parallel financial system 32 countries are using, and the U.S. isn't on the list.

|

|

Here's what most people are missing:

When access to the global money system becomes conditional, trade doesn't stop.

It reroutes.

Trump just threatened 25% tariffs on any nation trading with Iran. China, Russia, and dozens of other countries are now on notice.

But here's the thing:

Nations need energy. They need food. They need to trade.

You can't afford a single point of failure when one president can wake up and cut you off.

You can only threaten countries so many times before they find another solution to remove the risk.

When Russia got sanctioned and had reserves seized, the world learned a lesson:

If it can happen to a nuclear superpower, it can happen to anyone.

Trust broke.

And when trust breaks, nations don't just comply, they build alternatives.

|

|

Most people don't even realize that alternative has already been built. It's not coming. It's here:

- Hong Kong completed Phase 1 of a gold settlement system

- The Shanghai Gold Exchange opened its first offshore warehouse

- 32 countries now have swap lines to bypass the dollar entirely

- China's Project mBridge has processed over $55 billion, a 2,500x increase since 2022

Here's the mechanism most people don't understand:

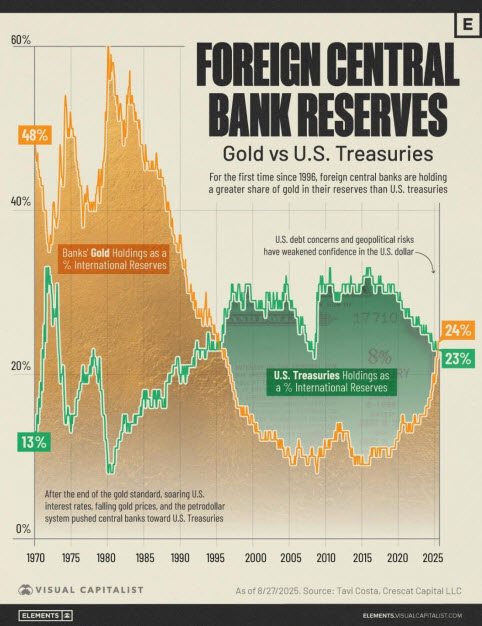

For decades, global trade worked like this: Countries trade in dollars, then hold U.S. Treasuries as their reserve collateral (the "safe" asset backing the system).

But this new parallel network works differently: Trade flows through RMB for liquidity, but settles in gold for trust.

|

|

Because gold can't be printed. Gold can't be seized remotely. Gold doesn't require trust in any single government.

China isn't trying to replace the dollar as reserve currency. They're replacing U.S. Treasuries as the world's reserve collateral.

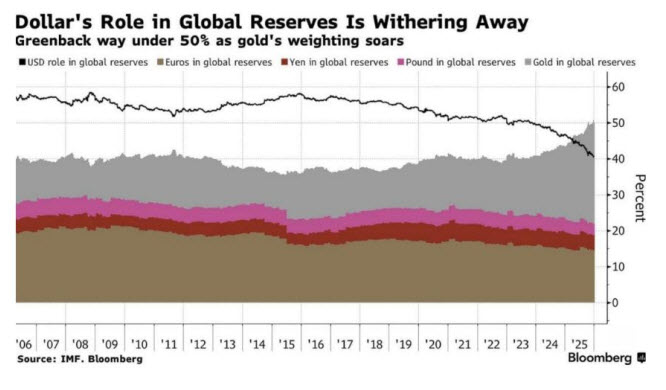

The data confirms the shift is real:

The dollar's share of global reserves has fallen from 60% a decade ago to 40% today. Central bank gold holdings have surged.

The network effect that made the dollar dominant is now working in reverse.

|

|

Here's the critical part most people don't understand:

Once nations switch systems, they don't come back. The switching cost is too high.

This doesn't roll back when tensions cool or tariffs drop.

The infrastructure is already built. It's already operational. And every new sanction just accelerates the migration.

So the real question isn't whether this shift is happening.

The real question is: what does this mean for your money?

Because if foreign nations stop holding dollar-denominated reserves, who funds the deficit?

If they stop buying U.S. Treasuries, who funds the deficit?

And if capital is flowing out of the old system into a new parallel network, where exactly is it going?

What's the collateral that doesn't depend on any single government's trust?

Most people are still measuring their wealth in a currency that's being structurally weakened.

They think their assets are growing, but they're not asking the right question:

Are your assets outpacing the debasement?

I just dropped a video on YouTube where I break down the exact mechanism of how this new system works...

And more importantly, what you need to hold to stay ahead of this shift.

Because understanding the problem is step one.

Positioning for it is step two.

Go check out the video here. Then drop a comment or hit reply here and let me know what you think.

|

|

|

|

To your wealth,

|

|

|

|

|